Expert Data Asset Monetisation Workshop

Data as the New Currency: Monetisation Pathways for Proprietary Databases

Introduction to Expert Data Asset Monetisation Workshop

Proprietary databases have become one of the most potent business resources in a digital economy where competitive advantage is becoming more reliant on the capacity to transform information into commercial value. Businesses in industries finance, logistics, retail, healthcare, manufacturing, and technology create large amounts of operational, behavioural and transactional data. However, only a small proportion of organisations turn this information into products or services that can be monetized in an organized fashion. The distinction between companies that collect data and the ones that make profit off this data is often in the way the companies are structured, governed and implemented.

This paper is dedicated to a single sphere: how organisations can commercialise proprietary databases using organised structures that translate raw data into repeatable and scalable streams of revenue.

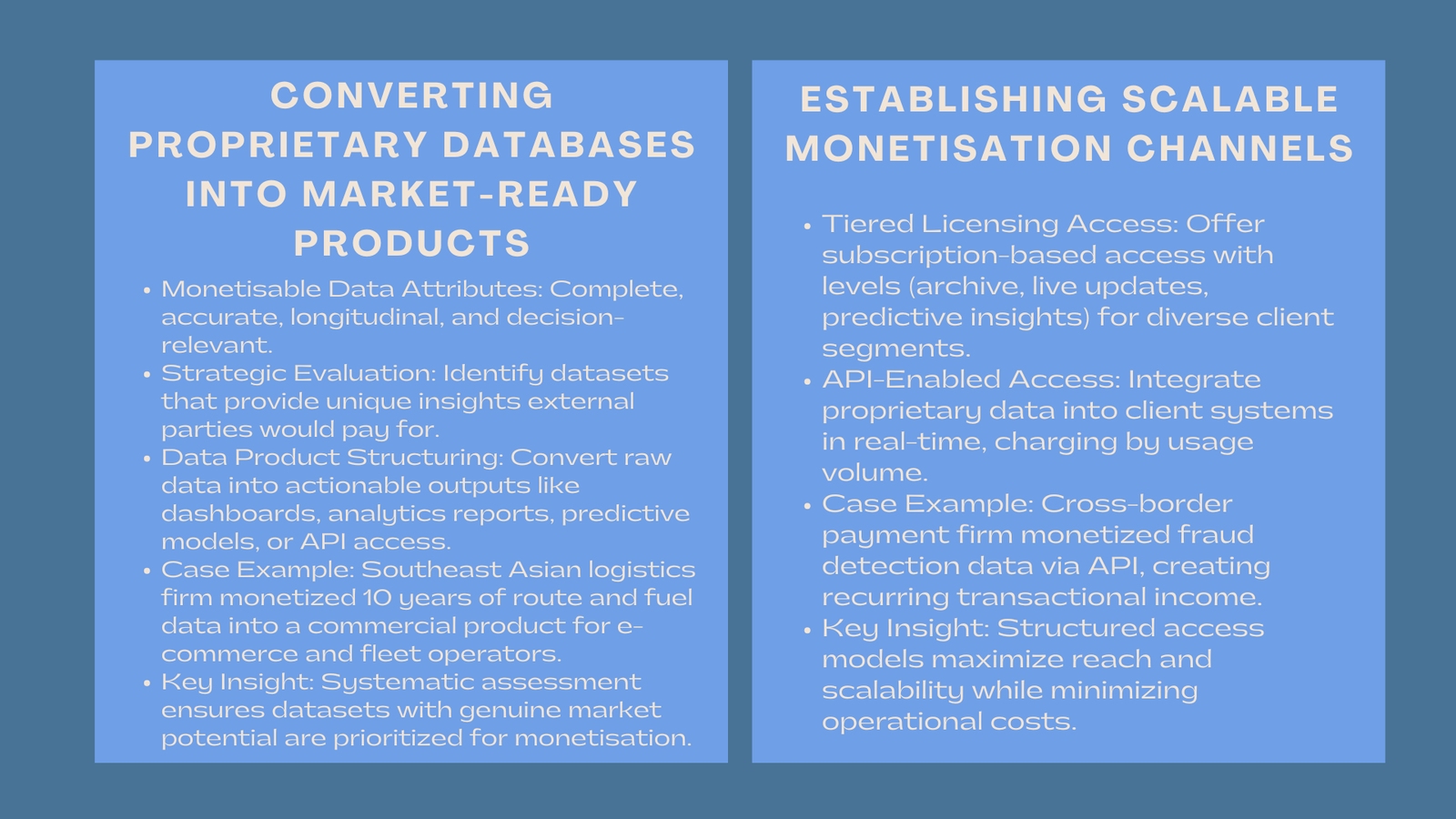

1. Converting Proprietary Databases into Market Ready Products.

1.1 What it Means to Have a Database that is Monetisable.

Data is not equally commercially valuable. Monetisable datasets are characterised by a number of attributes, including completeness, longitudinal depth, accuracy, and industry decision-making relevance. The organisations should consider whether their proprietary databases can provide insights previously unseen by external parties and which are willing to pay.

As an example, one of the regional logistics organizations in Southeast Asia had 10 years of route-efficiency information, fuel-consumption history, and the time deviation of delivery. Having studied competitor benchmarks, the company realised that its data provided unparalleled information on the trends in urban congestion in the emerging markets. By securing these insights into the data-access product that the fleet operators and e-commerce players can rely on, the company has created a different stream of revenue that is not tied to its transportation services.

This type of systematic evaluation is central to enterprise data monetisation strategy models, ensuring that organisations prioritise datasets with genuine market potential.

1.2 Structuring Data Into Products Clients Can Actually Use

Raw databases do not make money easily. Companies need to convert data into a form that solves actual business challenges – usually via dashboard, analytics report, predictive model, or access layer based on API.

In Europe, a retail payment platform turned its enormous movement database into quarterly bank-, FMCG companies-, and real-estate developer-specific Consumer Spending Intelligence Report. The report provided details on product categories, demographic trends, and regional differences – information the competitors did not have. The company was able to establish a superior market intelligence product that is used in various industries by placing the data in strategic positions.

Data product design must be transparent, have the capability to scale and be relevant- transforming raw data into decision making solutions that warrant regular purchase.

2. Establishing Scalable Monetisation Channels in Industries.

2.1 Tiered Access Model Under A License.

Another of the most popular revenue models is that of licensing access to datasets on a subscription basis. Other levels might consist of consolidated information, fine-grained datasets or feeds.

An analytics company specializing in real-estates, as an example, sold its transaction database in the real-estate industry to insurance companies, law firms, and banks. It provided three levels, including historical archive, live market updates, and predictive insights, which served to reach a wide range of client segments without exposing sensitive data.

Such structured models are effective for scalable proprietary data licensing frameworks, enabling organisations to monetise information across multiple industries with minimal operational overhead.

2.2 Leveraging APIs to Enable Real-Time, High-Value Monetisation

Data access that is API enabled gives customers the ability to incorporate proprietary insights into their systems. This is used in financial, logistic and cybersecurity applications.

The company that specialises in cross-border payments sold its database of frauds detection to institutions by offering API access to risk scores of banks and fintech systems. Clients incorporated these scores in their transaction screening engines, which they pay in terms of volume of use. The model created a recurring and transactional income and improved market confidence in the fraud expertise of the firm.

Monetisation based on API is extremely scalable, and in most cases, it becomes a focal point of a long-term partnership deal.

Applying Analytics and AI to Enhance the Value of Proprietary Data.

3.1 Improving the raw data using predictive modelling.

Companies add enhancements to the market value of their datasets by implementing predictive analytics and machine-learning applications. These enhancements do turn ordinary information to actionable foresight.

A manufacturing conglomerate applied machine-learning methods to transform its own records of equipment failures inside the company into a predictive maintenance engine. By providing access to this engine to the small manufacturers, it developed an advisory-based data product that assisted its clients in decreasing downtime. The conglomerate, in its turn, obtained a new source of revenues, which needed the regular model updates.

Predictive insights attract better charges since they directly enhance the performance of operations and lower financial risks.

3.2 Incorporating Data into Advisory and Consulting Solution.

In addition to pure data products, companies are also combining their own data into their consulting products. It is an expert interpretation and combination with unique information assets.

One global HR consultancy utilised its ample database of workforce mobility to provide counseling packages to multinationals considering regional transfers. The combination of information with strategic advice helped the firm to distinguish itself among the conventional consultancy firms, diversifying its high-margin services.

Integrated models enable organisations to not only monetize their expertise, but also their data at the same time.

4. Securing Legal, Ethical and Operational Preparedness to Monetisation.

4.1 Enhancing Data Governance to generate the trust of the market.

The data monetisation needs to be strictly governed i.e. a clear consent route, a right to use, anonymisation procedures, a respect to the documentation of corresponding legislations, i.e., GDPR, PDPA, or industry-specific policies.

A healthcare technology company that was getting ready to package its anonymised patient outcomes database into a monetised product invested a lot in one comprehensive consent management system and independent compliance audits. This gave the pharmaceutical clients the assurance that the information was of global ethical standards and the company was able to strike high licensing fees.

Good governance is not merely a tick in the box–a commercial distinguishing feature.

4.2 Sensitive Information Protection without undermining Commercial Value.

It is very important to find the balance between the protection of privacy and the usefulness of the data. Aggregation, efficient anonymisation and tokenisation will guarantee that commercialisation of datasets does not jeopardize confidentiality.

A behavioural risk-scoring data fintech business that did not disclose the identity of individual customers used dynamic anonymisation features. Financial institutions got useful feedback without meeting any of the sensitive personal information. This solution ensured integrity of privacy and business.

Strong privacy engineering increases the potential clientele and limits legal liability.

Conclusion

One of the strongest monetisation opportunities in the contemporary economy is represented by proprietary databases. Organizations that assess the business prospects of their data sets strategically, package information in products that can be used, roll out scalable access and models, and reinforce control are able to convert raw data into a flow of recurrent income. The organisations that excel in it do not just gather information but transform the information into actionable intelligence, predictive capabilities and value through subscriptions. In an era in which data is becoming currency, monetisation of proprietary databases will become the competitive advantage in industries over the coming years.