Certified Customer Relationship Cashflow Training

Turning Customer Relationships Into Predictable Cash Flow

Introduction to Certified Customer Relationship Cashflow Training

According to many, customer relationships are considered to be the intangible assets, but in the case of the successful companies; they are not that, they are designed, quantified and made money on them. This paper narrows down to the particular domain, which is how companies can convert long-term customer relationships into predictable, recurring cash flow by integrating financial discipline, retention science and structured monetisation models into their business model. In a market where expansion is becoming more costly and competition is brutal, firms that can transform current customers into a base of revenue streams will always do better compared to those that depend on the acquisition of new clients all the time.

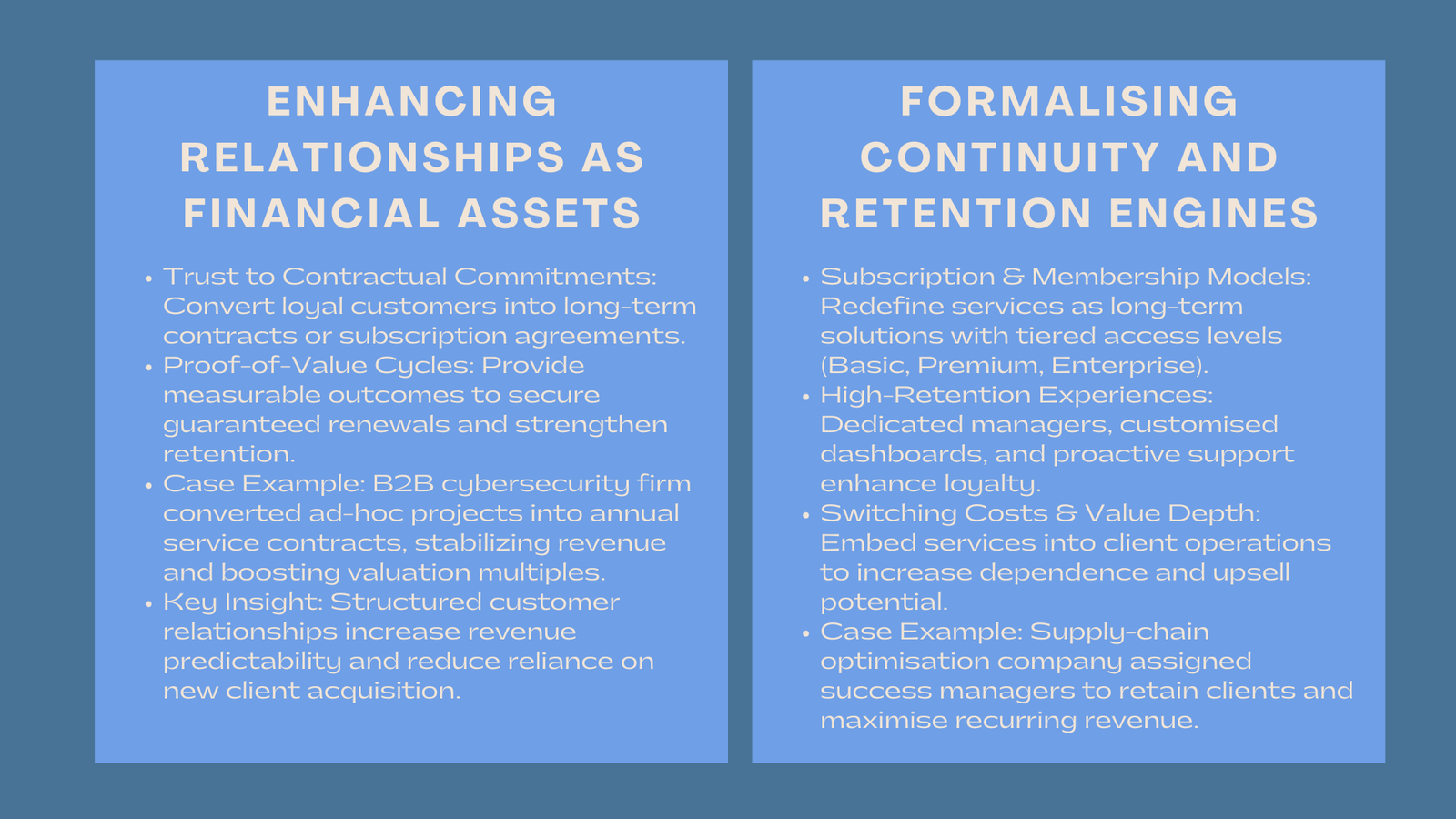

1. Enhancing the Quality of Relationships as a Financial Strategy.

1.1. Converting Trust to Contractual Committments.

The relationship between customer loyalty gains financial significance when it turns out to be more than a transactional one, but instead a structured commitment. Software, logistics, maintenance and consulting businesses often transform relationships of trust into service deals with a duration of many years. As an illustration, a B2B cybersecurity company that has established a retinue of customers can also start updating ad-hoc projects to annual contracts on monitoring, and turn unstable project revenue into a predictable monthly payment. This significantly increases the visibility of revenue in financial modelling, decreasing dependence on new sales cycles, and increasing the valuation multiples.

1.2. Predictability Locking In with Proof-of-Value Cycles.

Relationship goodwill can be translated into guaranteed renewals when companies are able to provide measurable outcomes. Value confirmation checkpoints, which are results quantification before renewing contracts, are increasingly being used in professional services firms. An example is a marketing analytics firm that may provide quarterly ROI dashboard, which shows an improvement in lead conversion. This cycle of proving value motivates customers to buy on a longer-term basis, builds retention and generates predictable payment cycles. This approach is especially relevant in sectors prioritising relationship-based revenue forecasting where client continuity is a major driver of financial stability.

2. Formalising Customer Continuity Through Subscription and Membership Models

2.1. Rebranding Services as Long-term Solutions.

Conventional service providers have the tendency to deal with uneven cash flows since the method of engagement is occasional. Even non-technical companies can become a subscription-oriented organization by redefining the current operations as a continuing solution. An HR consultancy can become a talent-management subscription of a monthly payment and no longer a recruitment assignment, including recruitment pipelines, onboarding, and performance audits. Such a shift removes the revenue gaps between the projects and creates a more in-depth, embedded relationship with the client.

2.2. Value Packaging into Tiered Access Levels.

Tiered subscriptions enable businesses to commercially capitalize on the different degrees of customer interaction. An example of a legal advisory firm would have a Basic, Premium and Enterprise plan based on various scopes of work, including basic compliance checks to high-touch litigation support. Access and priority through which the customer relationship is monetised is not just by service delivery. This model is increasingly used in industries applying the customer lifetime value optimisation strategy, where segmenting clients by value tiers maximises profitability while maintaining predictable monthly revenue streams.

3. Building Retention Engines That Naturally Expand Cash Flow

3.1. Designing High-Retention Experiences

Retention is important to predictable cash flow. Organisations that formalise outstanding after sales services, such as customised dashboards, specialised service, quarterly business meetings, experience retention levels that soar. Take an example of a supply-chain optimisation company where a specific success manager is given to each client. The manager also ensures clients derive maximum value of the service decreasing churn and maximising upsell. Compounding revenue effects result because high retention means a dollar retained becomes the basis of future growth as opposed to revenue that must be replaced.

3.2. Integrating Switching Costs and Value Depth.

The switching costs need not be punitive, they can be value based. The example of a cloud accounting company that embodies itself into the workings of a client, inventory, payroll, tax management, etc, is an inconvenient and risky switching process to the client. The more the integration then the stronger the relationship moat. Value depth also helps to nudge customers to spend more on higher service levels when the value added features (strategic forecasting, risk scoring or benchmarking analysis) provide some value that they cannot easily get in other places. This strategic richness transforms regular customers to revenue pillars.

4. How to use Relationship Intelligence to Recurrent Monetisation.

4.1. Analytical Customer Behaviour Mapping with Data.

Firms that have good customer relationships accumulate the wealth of behavioural information, use patterns, buying frequency, preferences when using the services, that can be analysed to predict needs and monetisable opportunities. An example of SaaS company is able to identify when users are about to hit usage limits and they receive an upsell proposal in time. Loyalty programs also help the retailers in following repeat purchase cycles so that they can then use it to automatically renew subscriptions to replenishment programs. Relationship intelligence will turn customer patterns into predictable revenue since businesses will not make guesses anymore, they will commercialize informed expectations.

4.2. Creation of Predictive Revenue Models.

The more developed firms convert relationship data into financial forecasting models which can convincingly predict retention, expansion and churn. Telecommunications, hospitality and insurance firms have been pioneering this approach over the decades but it is now being embraced by smaller firms. Under predictive models, a company could expect to see 30 percent of long-term customers upgrade to higher plans each year and conduct its budgeting, staffing, and resource planning processes based on sound assumptions. Predictive monetisation is a competitive edge: the company is more of a utility provider, whose relations with customers are a stable economy.

5. Upselling and cross-selling a Customer Base to achieve Customer Loyalty.

5.1. Tapping Additional Revenue Within the Existing Relationship.

Deepening revenue on the current customers is one of the most effective methods of acquiring predictable cash flow. The most successful upsell paths include premium service levels, add-on features, longer warranties, etc. when they correspond to the proven needs of the customer. A property management company may consider providing owners with long-term maintenance services on their assets by already having had quarterly maintenance. The barrier to purchase is also low because the relationship is already developed and the anticipated revenue will be more stabilized.

5.2. Development of Ecosystems of Complementary Services.

Cross-selling can be most effectively implemented in a situation where the customer perceives the provider as a key partner, as opposed to a vendor. A logistics company that provides warehousing has the opportunity to cross-sell last-mile delivery, inventory analytics dashboard, and customs coordination. All add-ons produce an effect of higher revenue stickiness, enhancing the predictability of cash inflows in the future. Those businesses that are successful in creating so-called service ecosystems around every single client tend to have much bigger revenue-per-customer ratios and longevity of operation over the course of many years.

Conclusion

Lucky cash flow is not a consequence of luck or hard selling but is the result of structuring customer relationships as long-term financial assets. Businesses can turn customers into solid economic engines by building more trust, entrenching subscription models, improving retention, leveraging relationship intelligence, and broadening value channels. In competitive markets, winning companies are not the ones that win the customers, but those that can translate the relationship to recurring, long-term revenue streams that multiply every year.