How Exclusive Distribution Rights Licenses Can Become Recurring Income Lines

How Exclusive Distribution Rights & Licenses Can Become Recurring Income Lines

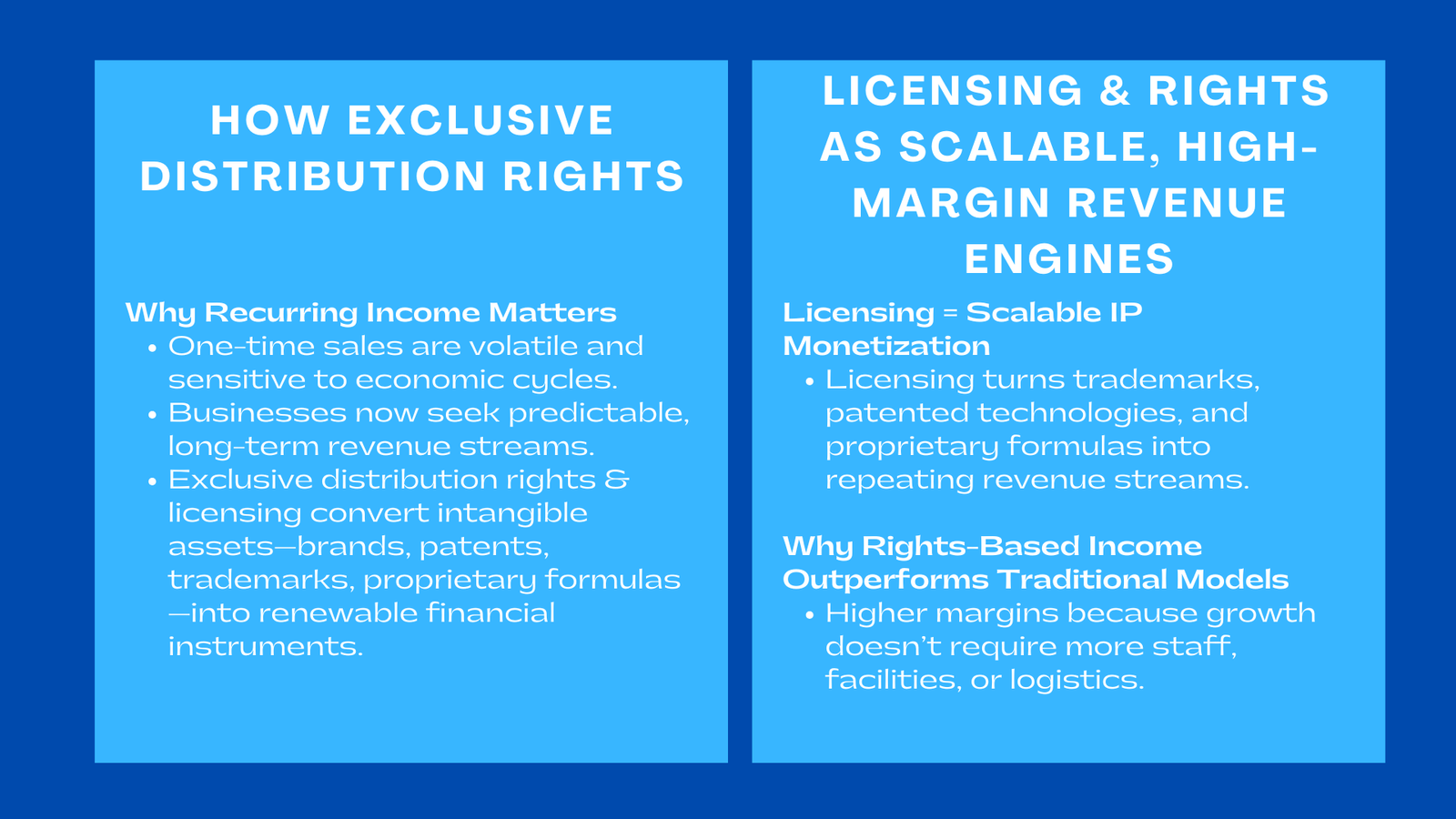

The power to create recurring revenue has emerged in the contemporary business world as a hallmark of sound business sustainability. Businesses are realizing that one-time sales, regardless of their quality, are always volatile, prone to economic influences, customer turnover, and emergence of new competitors. As a result, this has caused a fundamental paradigm change: through the means of exclusive distribution rights and licensing arrangements, companies are no longer depending on products or the working mechanism of operation to have predictable, long-term revenues. These rights constitute a kind of sellable control that converts intangible resources, brands, patents, proprietary formulas, trademarks and channel of the market, into financial instruments to be renewed. With the changing of market landscape and the onset of competition, digital transformation grants markets and business opportunities a new channel of sustainable growth, which would not necessarily need the alignment of resources.

In the past, the expansion of businesses was on the basis of scaling up physical infrastructure, production or labor force. The world today is experiencing an expansion of companies in terms of intellectual property and strategy outlines. Exclusive distribution rights and licenses would enable organizations to increase the scope of their commercial presence without making the operation more complex. This development can be compared to the larger change in the nature of growth in the digital era to that in the how to generate recurring revenue through exclusive distribution rights industrial one, where gathering capital outlay is the main driver of growth, versus in the digital era, where the trading of knowledge, brand power, and intellectual property is the basis of creating value. Due to the desire among companies to safeguard margins and eliminate risk, exclusive rights have become one of the most desirable long term recurrent cash flow models.

The Economic Logic Behind Exclusive Distribution Rights

Exclusivity as a Source of Scarcity, Influence, and Pricing Power

Intense rights of distribution are effective since they lead to scarcity. When the product is available to just one distributor in a specific area then the exclusivity will be a higher value. The scarcity promotes the bargaining power, predictability of demand and the establishment of stronger brand consistency. The rights holders receive some control over the way their products are sold and packaged, whereas the distributors have a competitive edge, which they would not have managed to garner on their own. This is where their interdependence is crucial in that both sides are able to derive a lot of value in the arrangement open to both parties, especially in industries where frameworks such as a Singapore business valuation course for litigation and dispute resolution help professionals understand the financial implications of exclusivity.

How Exclusivity Converts Into Reliable, Contract-Based Cash Flow

Contractual financial obligations are almost always present in exclusive rights where the exclusivity is converted into recurring income. These could be in the form of yearly licensing, assured of purchases, access charges to territories, commitment to be renewed and provision of a percent of royalty that increases. The fact that these financial commitments are contractual in nature, contributes to the prediction of a cash flow irrespective of the variations of demand as per quarterly. This dependability transforms exclusive rights into long term financial stocks that welcome the overall corporate planning, investment choices and market expansion strategies.

Licensing as a Scalable Intellectual Property Monetization Strategy

Turning Intellectual Property Into a Financial Asset

One of the most effective methods of revenue collection of the intellectual property is licensing. Instead of creating, selling or distributing goods or services, owners of rights give out their intellectual property to other corporations to use with the agreement of paying them periodically. Intangible assets that are not easily quantifiable like trademarks, patents, proprietary formulas, and technological innovations are converted into foreseeable revenue streams through licensing. The latter model is particularly effective since it enables intellectual property to operate without the effort of the ownership doing anything in relation to activity.

The Multiplicative Effect of Licensing Across Regions and Industries

The scalability of licensing is that it can be used to duplicate intellectual property in many regions, partners and industries at the same time. A patent has the potential of generating dozens of licensees in various continents. One brand name trade can be licensed to third parties distributors, manufacturers or franchisees who are operating in completely different markets. This multiplicative effect enables IP owners to generate their revenue in the form of exponential growth, with the help of the same underlying asset. Once the market continues to grow, expansion of the application follows and the renewal process also adds up leading the intellectual property to become a compounding financial tool.

Why Exclusive Rights Generate Higher-Value Recurring Income

Market Protection and Competitive Insulation as Revenue Drivers

Distributors will be more than ready to pay higher prices on exclusivity as exclusivity opens some degree of protection unavailable to non-exclusive models. Whenever a distributor is aware that he or she is the sole representative of the organization in a given territory, the distributor can be assured to invest in their marketing, logistics, inventory and branding activities. They are slowly going on their business without the threat of being choked off by other companies who are selling the same product. This reduces market uncertainty, and elevates the desire of the distributor involved to undertake more minimum purchase volumes or higher licensing fees per annum. Directly, rights holders have the advantage of more and more purposeful income, and indirectly, of more penetration to the market, by the inspiration of motivated distributors.

The Strategic Value of Deep, Long-Term Distribution Relationships

The distribution rights that are exclusive give entrenched partnerships compared to a transactional sales. Since the distributor is given protection in the territory, the distributor becomes interested in maximizing the market share and increasing the product visibility. These more profound relationships are easier to communicate with and work together and aim at more stable planting of the contracts based on renewal. The outcome is stability in income earned by the holder of the right in the long-term. Encircling such a structure of partnership is a financial ecosystem, in which both partners have performance obligations, and on this platform, there emerges a culture of recurring income, which increases with the maturing of the market.

Building a Rights-Based Business Model

Designing Contracts That Institutionalize Recurring Revenue

The basis of recurring income on exclusivity of rights is on the nature of the contract itself. The major ones are the renewal terms, royalty provisions, limits of exclusivity, performance norms and standards on compliance. With the right wordings, such terms guarantee the owner of the right long-term revenue and the distributor a stable market prospect. Contract styles must be developed in a way that entices consistent investing on the part of the distributor as well as consistent payments to invigorate the flow of recurrent revenues of the rights holder.

Aligning Economic Interests Between Rights Holder and Licensee

A business model that is based on rights gets successful when economic value exists in both directions. The rights holders are required to offer good brand loyalty, safeguard against sales by unauthorized persons and quality products. Distributors should be willing to develop demand, create brand excellence and fulfill the standards of the contractual performance. The symbiosis between the two parties creates a very sustainable partnership and repetition of revenue is achievable and stable.

Geographic and Channel Exclusivity as Income Multipliers

Territorial Exclusivity Creating Stable Regional Income Nodes

Exclusiveness of territory enables the rights owner to cut up the global markets or national markets into different revenue units. Every region will be its own source of income and will have its own contract, schedule of payments and compliance. The effect of this geographic segmentation is that it generates lattice patterns of recurring revenues that stabilize the cash position of the rights holder. With high demand, the price of the rights to exclusivity over the territory grows significantly, which allows the owner of such rights to discuss higher charges or better terms of the contracts.

Channel Exclusivity Strengthening Market Control and Revenue Diversity

Besides the exclusivity based on geography, channel-based exclusivity can be granted by the rights holders as retail, wholesale, pharmacy, hospitality, or e-commerce. The exclusivity on channels generates more layers of recurrence revenues, since the licensees have to pay to have access to their specific distribution channels. The segmentation enables firms to maximize revenue collections in various market segments without having to overlap operational facilities. All channels are predictable controlled gateways that would add to overall recurring revenue.

Licensing and Distribution Rights as Components of a Diversified Revenue Portfolio

Developing Multi-Layered Income Streams From a Single Intellectual Asset

Innovations such as a single brand or one patented technology can be used to produce multiple streams of income due to well stratified agreements. An example is that a trademark might be licensed to a producer, sold in a region by an exclusive distributor and be re-licensed to a third party who might use the brand in related products. This has a layered approach and it brings one intellectual property asset into a portfolio of recurring lines of revenue. A diversification of agreements provides the financial strength and loss of dependability on one partner or one market.

Enhancing Lifetime Customer Value Through Renewal and Expansion

Recurring income is fortified with licensees taking out new terms, new territories or new rights. The cycles of renewals will also be the major points of increasing revenue, with rights holders being able to renegotiate the conditions, according to market development, the rise of brand value, or new competitive forces. With time, the lifetime value of both partners gains even greater value, which develops compounding financial advantages.

The Scalability and Global Reach of Rights-Based Income

Why Rights-Based Revenue Has Exponentially Higher Margins

Right based revenue does not necessitate incremental cost as much of the manufacturing or service based income as it increases. The owner of the rights is not required to employ more people, establish new facilities and supply chains. This low cost model to the extreme allows high margins and great scalability. After establishing the system, there is a rise in income with every new contract, renewal and expansion without adding any complexity in the operation.

Global Expansion With Minimal Operational Risk

Business models that are rights based would enable a company to be spread to various international markets without internalizing the operational difficulties in the host country. The logistics, regulatory compliance, cultural adjustment and market development are managed by the distributors. The rights holders only get the recurrent payments without loss of strategic control of brand and intellectual property. This forms a world wide income model which expands without boundaries, overhead and geographical risk.

Conclusion to How Exclusive Distribution Rights Licenses Can Become Recurring Income Lines

Only the distribution rights and licensing are one of the best tools to make up recurring revenue within the current economy. Instead of using intellectual property and market power to back businesses, they can convert this to recurring monetary assets enabling companies to develop permanent, predictable, and scalable revenue streams. Such agreements when put into organisation, bring these incentives close together, lessen the load on operations and increase the global reach of a business into new territories and markets. Exclusivity keeps those who are the holders of rights to extract more value and also enables the distributors to establish defensible market positions and this leads to an ecosystem of recurrent incomes that fortifies with time.

With the development of the global market, companies that are based on products sales or traditional services will become even more volatile. Conversely, rights owners that master the art of exclusivity, licensing as well as monetization of intellectual property will enjoy a predictable cash flow, scalable revenues as well as growth in compounds. The winners in the future will not be those who possess the largest quantities of factories or even the largest number of employees but licensing strategies for converting intellectual property into long-term income; those who will possess the most valuable rights and strategically license them to the high-performance partners. Rights based recurring income is not only the opportunity, but a hall mark of resilient, future ready business.