Professional Intangible Valuation Frameworks Course

Advanced Frameworks for Intangible Assets Valuation: Assessment, Measurement, and Impairment in Modern Corporations

Guide on Professional Intangible Valuation Frameworks Course

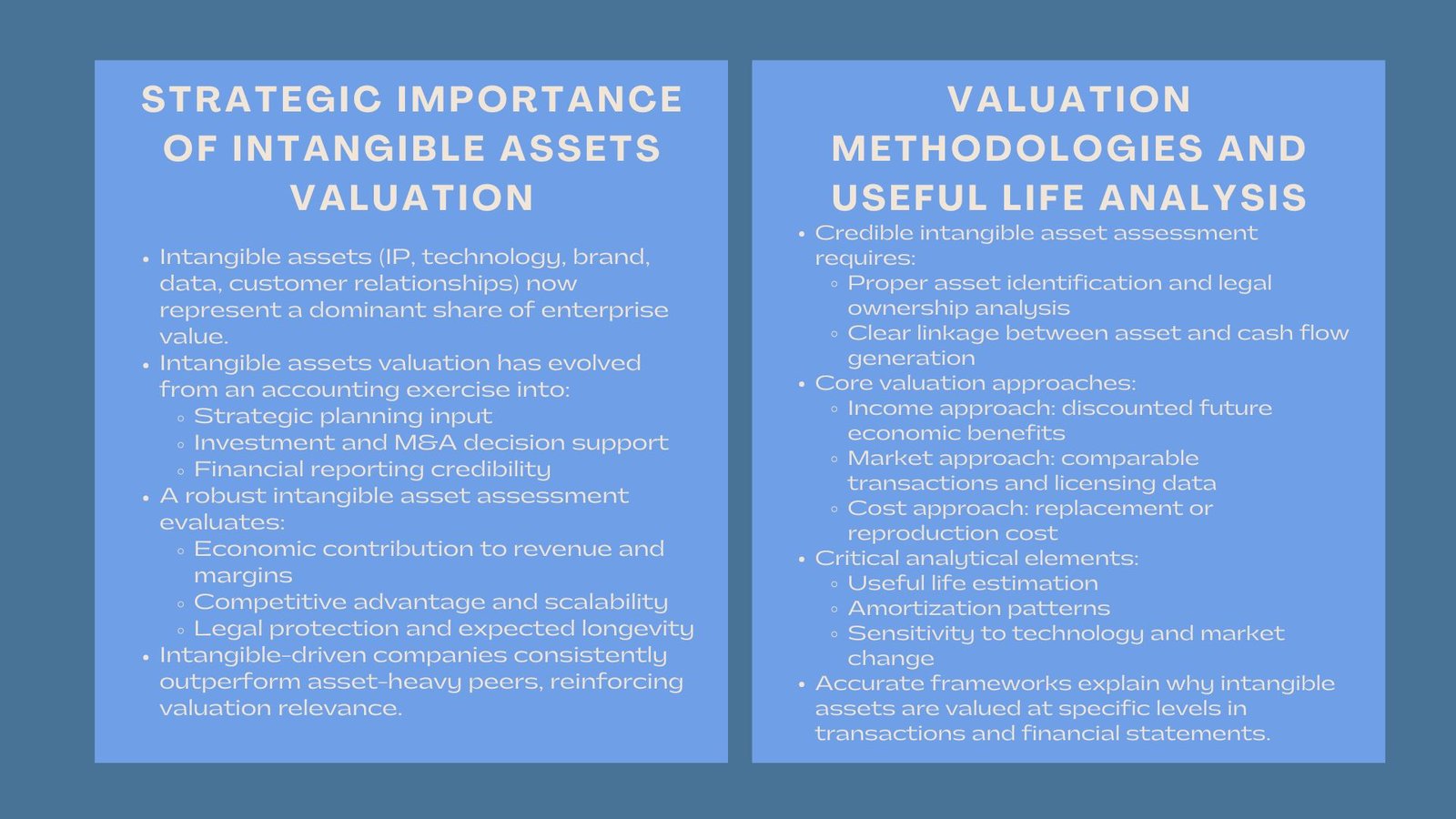

In the contemporary business environment, intangible assets valuation has become a central pillar of financial analysis, strategic planning, and corporate reporting. With the shift to digital transformation, the creation of intellectual property, the growth of a brand, and the development of innovative technological capabilities, intangible assets now uphold a considerable share of the overall enterprise value. It will be necessary to conduct credible valuation work that requires a detailed insight into the contribution of intangible assets to revenue generation, competitive advantage, efficiency in operations, and scalability over the long term.

Such an increase in importance implies that a well-developed intangible asset assessment is no longer a luxury, but a necessity to investors, auditors, regulators, valuation experts and executive decision-makers. Due to the importance of the role of intangible assets in determining the corporate worth, there is greater interest in understanding the reasons why intangible assets should be valued at certain levels in financial statements. In parallel, organizations must conduct ongoing intangible asset impairment assessment to ensure reported values remain accurate when market conditions change.

The Strategic Role of Intangible Assets in Corporate Value Creation

The nature of the company’s competition and growth is progressing into more intangible assets. Innovation, technological infrastructure, proprietary software, customer relations, data analytics, and brand strength are more important to the modern economy. These resources create economic advantages that are way beyond the conventional material resources.

Consequently, the valuation of intangible assets has ceased to be an accounting technicality, and it is now a strategic science, which ascertains the price of acquisition, investment returns, and the value creation over the long term. Whenever a valuation professional is undertaking an intangible asset assessment he/she looks not just at the financial implication of the asset, but also the strategic relevance, market position, legal protection, and probable longevity of the asset. These factors collectively influence why certain intangible assets are valued at higher levels than others.

The growth of digital infrastructure, the development of artificial intelligence, automation features and high-quality intellectual property portfolios are examples of why intangible assets are such valuable assets. The world of research continuously reveals that intangible-driven firms excel over the ones that thrive on material resources most of the time. The trend supports the importance of having high intangible asset impairment assessment standards, where the companies do not over-report asset values in such economic recessions, technological shocks, or regulatory changes.

Key Drivers Behind the High Valuation of Intangible Assets

Companies often question why intangible assets are valued at levels that surpass physical infrastructure. This is explained by the fact that they are very powerful in terms of economic gains. Cycles of innovation are shortened, and companies are dependent on their own technology, algorithms, and digital economies to be competitive.

The intellectual property rights allow firms to gain access to exclusive market niches and create a stream of repeated revenues. Loyalty is created through customer relations, brand reputation, and data intelligence that enhance the pricing power and cost of acquisition. Digital assets can also be easily scaled and do not demand high incremental expenditures as tangible assets do. These performance characteristics directly shape intangible assets valuation outcomes and justify higher asset values across many industries.

Moreover, intangible assets are highly embedded in long-term strategy. They promote efficiency of operations, speed up product development, help in promoting their growth in the market as well as promoting their risk management frameworks. Their contributions are multidimensional and define why it requires careful intangible asset valuation to amass economic value in the most appropriate way. Those companies, which cannot explain the worth of these assets, tend to have troubles during the merger, acquisition, negotiations, investor briefings and financial reporting settings.

Professional Approaches to Intangible Asset Valuation

To perform credible intangible assets valuation, applied economic theory is needed together with specialised modelling, benchmarking of the market and extensive industry knowledge. The first step taken by analysts is to identify intangible assets appropriately because they may be misclassified which may result in poor reporting and regulatory issues. Some of the issues to be considered are legal ownership, contractual rights, uniqueness of innovation, and anticipated contribution to financial performance. When the asset is well defined, analysts determine the way the asset creates economic value. This analysis is used to decide on the most suitable approach to valuation.

The income method is common in cases where the intangible asset has direct financial benefits, and the future benefits have to be predicted carefully and discounted benefits have to be estimated to the current value. The market approach is used where there are similar transactions or licensing deals even though the comparability may be restricted. The cost method is applicable in the situation where the software or databases and technical systems developed internally are valued and the economic benefits are indirect. Such methodologies do not only determine the value of the assets, but also justify the reason behind the valuation of intangible assets to specific amounts of valuation in the financial statements and acquisition price scenarios.

Another important element of intangible asset assessment is useful life analysis as the valuation should take into consideration the duration of time that this asset will pay off in terms of economy. The useful life is affected by the legal protection, terms of renewal, the technological trends, as well as the competitive factors. Poor amortization or impairment recognition may be as a result of a misestimation. This interrelatedness shows why the valuation process should be thorough, evidence-based, and oriented towards the international standards.

The Increasing Importance of Intangible Asset Impairment Assessment

Considering that the intangible assets own a higher percentage of corporate value, even the strictness of intangible asset impairment assessment is increased. The assessment of impairment is done to ascertain that the intangible assets in the balance sheet sheets can be recovered and that such statements present a true reflection of the economic reality. Businesses follow the market environment, regulatory developments, and internal performance indicators to define the possible impairment factors. In case there is a trigger, analysts have to calculate the amount of the intangible asset that can be recovered and compare it to the carrying value of the asset. In case the recoverable amount is less, then the impairment should be identified and recorded.

The impairment process requires elaborate documentation, which includes assumptions on cash flows, discount rates, competitive forces, market forces, and technological advances. Since the impairment reviews frequently have an impact on the perception of investors and the audit examination, it is imperative that the companies should back their determinations with a solid analytical explanation. These reviews also support the reasons as to why intangible assets are worth certain values, explaining the association of economic benefit, exposure to risks, and the long-lasting viability of assets.

Challenges in the Valuation and Assessment of Intangible Assets

Despite the fact that the significance of intangible assets valuation is constantly increasing, the procedure is still rather difficult. A number of intangible assets are unique and, as such, there is fewer similar market evidence. The high rate of technological innovation reduces the lifespan of assets and brings about ambiguity. Complex organization also tends to imply that there are a number of intangible assets that work together in creating value, making it difficult to separate cash flows.

Valuation professionals are also faced with intellectual property conflicts, regulatory ambiguity, and inconsistency between the global market. These barriers justify the necessity of the elaborated intangible assets assessment procedures and the continuous development of the valuation models. The fact that the reviews of impairment are another complex issue that necessitates that companies will be careful of the dynamics in the market. With the changing of the industries, increased and strict assessment of intangible assets impairment will be needed at a more frequent rate to keep financial alignment.

Integrating Intangible Asset Valuation into Corporate Strategy

The intangible assets valuation is becoming an important part of the high level planning and decision making of companies. The lessons learned during valuation exercises assist the executive team in performing accurate mergers and acquisitions, negotiating licensing deals, justifying investment priorities, warranting innovation investments, and enhancing the market positioning strategies. When the leadership realizes the reason behind the valuation of intangible assets at certain levels, they are in a position to spend resources in a more efficient manner as well as to create value sustainably.

Effective valuation also ensures better communication of investors, increased transparency and better governance of a company. No less important, disciplined attitude toward intangible asset assessment facilitates long-term performance improvement by helping companies to adjust rapidly to the changes in the industry and technological upheavals. With the ever changing markets, the imperativeness of holistic intangible asset impairment valuation systems will continue to compound.

Conclusion: The Future of Intangible Asset Valuation and Corporate Value Creation

The intangible assets keep reinventing competitive edge, financial reporting, and strategic leadership in the global industries. The increasing reliance on intellectual property, digital platforms, data systems, and customer engagement models demonstrates why intangible assets valuation is critical for modern business success. Companies must understand how intangible assets generate value, why intangible assets are valued at specific levels, and how disciplined intangible asset assessment enhances strategic decision-making.

At the same time, organizations must conduct rigorous intangible asset impairment assessment to ensure financial accuracy and regulatory compliance. By adopting comprehensive valuation and assessment frameworks, businesses reinforce transparency, strengthen market competitiveness, and position themselves for long-term growth in an increasingly intangible-driven world.