Accredited FRS 38 Valuation Course

Intangible Assets FRS 38 and Modern Valuation Practice: A Professional Guide to Intangible Asset Valuation, Case Applications, and Industry Resources

Introduction to Accredited FRS 38 Valuation Course

In the contemporary knowledge-based economy, a corporation no longer relies on physical assets to dictate its corporate value. Brands, patents, customer relationships, software platform, proprietary processes and data now constitute a significant share of enterprise value. Consequently, the implementation of intangible assets FRS 38 has emerged to be a major technical and strategic concern to financial controllers, valuation experts, auditors, and corporate executives.

Meanwhile, the working realities of intangible assets in valuation and the rising role of the intangible asset valuation company together with the rising need to know about the real world via a case of intangible assets valuation and the increasing demand for real-world insight through an intangible asset valuation case and every reputable intangible assets valuation book continue to reshape professional practice. This paper presents a narrow, technical, and practical analysis of the ways that FRS 38 is responding to the current valuation requirements in actual business contexts.

1. The Role of Intangible Assets FRS 38 in Financial and Valuation Reporting

1.1 Technical Foundation of Intangible Assets FRS 38

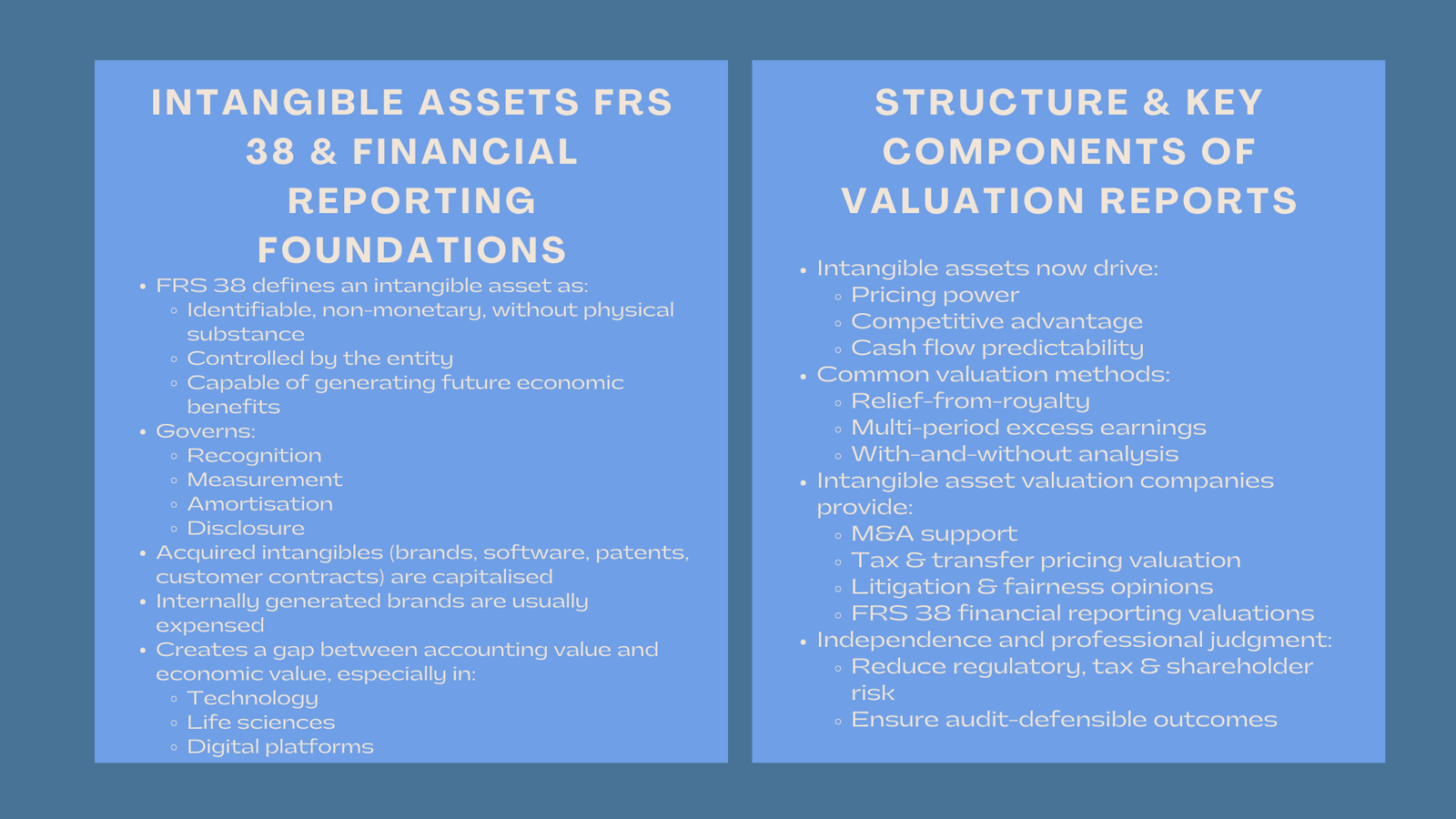

Intangible assets FRS 38 establishes the international accounting framework governing the recognition, measurement, amortisation, and disclosure of intangible assets. It establishes that an intangible asset is an identifiable, intangible, non-monetary asset that lacks physical existence and is controlled by an entity and which can be used to generate future economic benefits. This technical definition is the structural basis of all professional work that involves intangible assets in valuation where only such assets that satisfy these definitional and recognition criteria can be capitalised on the balance sheet.

Direct effects of FRS 38 in post-acquisition accounting The direct effect of FRS 38 in post-acquisition accounting is the measurement and reporting of acquired intangibles (e.g. trademarks, customer contracts, software platforms, proprietary technology). This accounting treatment now becomes the major numerical input of valuation models in litigation, capital raising, restructuring, and tax planning.

1.2 Recognition and Measurement Implications for Valuation

Under intangible assets FRS 38, recognition of intangible assets is only possible when future economical benefits are likely and the cost is reliable to measure. Internally generated brands such as those, are normally reported as an expense whereas acquired ones are reported as capital. This difference has a fundamental impact on the way in which intangible assets in valuation are dealt with in practice when it comes to valuation. Valuers have to balance accounting-based recognition with economic reality, particularly where internally prepared value drivers reflect that the main driver of enterprise value.

The gap between accounting value and economic value is often huge in technology companies, biomedical research organizations and digital platforms, so professional valuation judgement is necessary.

2. Intangible Assets in Valuation: From Accounting Numbers to Economic Reality

2.1 The Strategic Importance of Intangible Assets in Valuation

The utilization of intangible assets in valuation goes way beyond the adherence to reporting standards. The economic moat of modern day business is often represented by intangible assets. The brand equity affects the price power, patented technologies dictate the competitiveness, and the relationships with customers bring predictability in the cash flow. The valuation professionals are therefore expected to convert the accounting-based recognition of assets to their future economic value models.

Licensing strategy and premium pricing entirely depend on brand valuation in consumer goods markets. The R&D recoverability in the case of pharmaceutical industries is motivated by patent valuation. User data and proprietary algorithms prevail in the value creation in digital services. Intangible assets in valuation, in both cases, become the determinant of the results of transactions and corporate strategy.

2.2 Linking Valuation Methodologies with FRS 38

The most frequently used income-based techniques used by valuers in the valuation of intangible assets are relief-from- royalty, multi-period excess earnings, and with-and-without analysis. While intangible assets FRS 38 governs recognition and disclosure, valuation methodologies remain driven by economic principles rather than accounting constructs. It is one of the most difficult professional assignments in contemporary corporate finance to reconcile these two frameworks.

As an example, a trademark previously recognised in FRS 38 at the purchase price can be subject to revaluation in a licensing dispute in terms of the premiums of projected revenue in comparison with market alternatives. This reprisal is usually very different in comparison with book value which underscores the dual-track accounting and valuation.

3. The Expanding Role of the Intangible Asset Valuation Company

3.1 Why Enterprises Rely on Intangible Asset Valuation Companies

The complexity of valuation has been increasing, which has led to the expansion of the specialist intangible asset valuation company services across the globe. These companies have a multidisciplinary background of accounting standards, financial modelling, legal frameworks, and technical expertise of the industry. Valuation specialists are a regular feature of companies as they undertake mergers and acquisitions, as well as conduct tax compliance, litigation support, fairness opinion and financial reporting in standards like FRS 38.

A global consumer brand reorganising its intellectual property rights can frequently necessitate intangible assets valuation companies to conduct transfer pricing, tax authority bargaining, and final balance sheet reorganisation at the same time. Regulatory acceptance, as well as investor confidence, is directly influenced by the credibility of the person who does the valuation.

3.2 Risk, Independence, and Professional Judgement

The intangible asset value sensitivity to the economy puts organisations under regulatory challenge, tax suits and litigation by shareholders. The independent valuation firms also conduct risk-reduction functions, through enforcing defendable valuation models that correspond with the intangible assets FRS 38 and international valuation criteria. Their activities will have to be subjected to the scrutiny of auditors, regulators and courts of law.

In the cross border acquisitions, the deferred tax liabilities and post acquisition earnings volatility are likely to be directly influenced by the valuation opinions on customer relationships, proprietary technology and trademarks. The risk of financial misstatement is very high without the contribution of professional opinion.

4. Learning Through Practice: The Value of an Intangible Asset Valuation Case

4.1 Acquisition Valuation of a Technology Platform

One example of an intangible asset valuation case is an acquisition of a software-as-a-service (SaaS) company by a listed enterprise. The exercise of purchase price allocation showed that intangible assets that could be separated and identified using the FRS 38 proprietary software, customer contracts, and brand recognition. The valuation team used a multi-period excess earnings model of the relationships with the customers, the relief-from-royalty approach to the software platform, as well as the market-based approach to the brand valuation.

The result showed that more than 65 percent of the price of the acquisition was associated with intangible and not tangible assets. This had a material impact on post-acquisition amortisation, pre-tax deficits and earnings volatility. As the case shows, intangible assets in valuation have a direct effect on the price of transactions, as well as the financial reporting result.

4.2 Litigation and Damage Quantification

Another common intangible asset valuation case arises in intellectual property infringement disputes. A medical device company that was defending a patent infringement claim needed to have its lost economic benefit valuation whereby it would have had exclusive access to the market. This valuation clearly distinguished between valuing patent and goodwill in intangible assets FRS 38, generating an estimate of damage that is defensible using projected opportunity cost.

The methodology of disciplined valuations and assumptions in documents are becoming significant to the courts. The strength of the valuation analysis usually defines the results of litigation and leverage of settlement.

5. The Role of Knowledge Resources: The Intangible Assets Valuation Book

5.1 Why Formal Study Remains Critical

Intangible valuation skills require a formal theoretical base despite the developments in modelling software and automation. Every serious intangible assets valuation book addresses the intersection of accounting standards, valuation theory, legal enforceability, and market behaviour. These resources offer conceptual models that are required in steering the conflict between accounting recognition in FRS 38 and economic valuation both in transaction and dispute purposes.

Scholars planning to gain high-level certification in valuation, forensic accounting, or corporate finance are highly dependent upon the organised academic resources to instill consistency in judgement and methodological discipline.

5.2 Bridging Theory and Applied Valuation

A good intangible assets valuation book usually contains theoretical measurement models, regulatory interpretations of intangible assets FRS 38, and numerous realistic intangible asset valuation case studies. This integration will enable the practitioners not only to know how to calculate the value, but also how this value will be disputed, audited, and justified.

Other emerging asset classes like algorithms, platform ecosystems, data sets and carbon credits are also critically examined in such literature, which are spheres where the traditional accounting frameworks are still developing.

6. Governance, Audit, and Regulatory Oversight of Intangible Assets

6.1 Audit Implications of Intangible Asset Valuation

The intangible asset FRS 38 is one of the accounting standards most susceptible to judgements in terms of audit. Auditors should assess what the management assumes concerning the forecast cash flows, discount rates and useful lives and the impairment triggers. The valuation of intangible assets can be the source of estimation uncertainty in financial statements that is often the largest one.

Where third-party intangible asset valuation company reports are used, auditors rigorously assess the competence, independence, and methodology robustness of the valuation providers. This supports the relevance of defensible valuation practices at the strategic level.

6.2 Regulatory and Tax Scrutiny

Tax authorities globally are intensifying their review of intangible asset valuations, particularly in transfer pricing arrangements involving intellectual property migration. Valuation assumptions affecting royalty rates, development cost allocation, and the allocation of development costs and profit attribution should conform to the tax law as well as intangible assets reporting requirements of FRS 38.

Differences between statutory reporting and internal economic reporting raise more and more audit adjustments, fines and long-term tax dispute.

7. The Future of Intangible Assets in Valuation Practice

7.1 Data, Artificial Intelligence, and Advanced Modelling

Big data analytics, artificial intelligence, and real-time market intelligence are some of the technologies being used to reform the future of intangible assets in the valuation process. Valuation models are no longer just a simple spreadsheet projection but are being transformed into dynamic simulation environments which can be used to stress test thousands of scenarios. These features enhance valuation defensibility in addition to raising regulatory standards of technical sophistication.

To the valuation practitioners in an intangible asset valuation company, this technological transformation demands the ongoing professional training, the greater incorporation of software use and more statistical modelling skills.

7.2 ESG, Sustainability, and Intangible Value

Green, social and governance factors are quickly turning into process-financialised elements of enterprise valuation. Reputation, regulatory goodwill, carbon credits, and stakeholder trust are met with an increasing amount of the economic valuation requirements of intangible assets, but official recognition as an intangible asset under FRS 38 is a professionally contested area.

The conceptual definition of intangible value will likely grow to more areas in the future with accounting standards and valuation guidelines being revised to incorporate more of the concept.

Conclusion

The tactical applicability of intangible assets has not been higher. Intangible assets FRS 38 provides the formal accounting structure that governs recognition and disclosure, but the economic reality of intangible assets in valuation extends far beyond bookkeeping compliance. The experience of the intangible asset valuation company, the wisdom of all intangible asset valuation cases, and the guiding principles embedded in each quality intangible assets valuation book volume all contribute to the way the contemporary business quantifies, protects and exploits intangible value.

With corporations growing more innovation based, branding, owning data and intellectual property, intangible assets valuation will continue to be the core of financial strategy, regulatory compliance, and long-term value creation by shareholders. Those organisations which master this discipline will not only be able to report value more accurately but they will also be able to manage and multiply the value with confidence in a fast-changing globalised economy.