Expert In-House Tech Revenue Course

From R&D to Revenue: Commercialising In-House Technology Successfully

Introduction to Expert In-House Tech Revenue Course

Most firms have research and development projects that take millions of dollars to establish but very few of that research and development ever make it into a commercial product. Technologies are lying idle in the lab, ideas are being held up in prototypes and internal innovations are never commercialised by the organisation just because they do not have a systematic commercialisation channel. The article narrows down to one particular area, namely how firms can transform internally developed technology into market ready revenue generating products with disciplined evaluation, systematic models of monetisation and strategic go to market implementation. Making R&D a source of revenue is not a chance event–it is an eventuality.

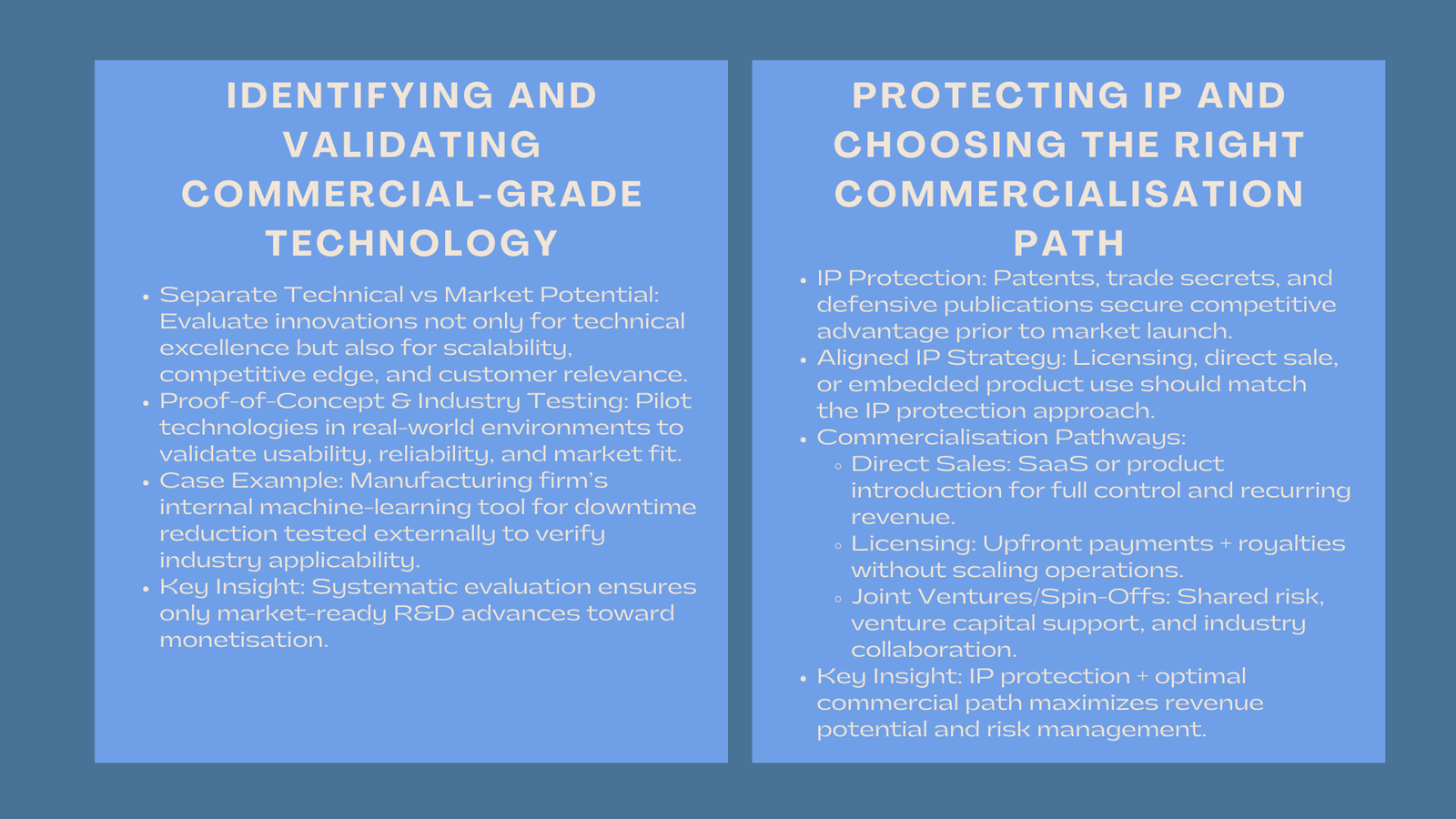

1. Determining Commercial-Grade Technology In the Organisation.

1.1. Separating Technical Potential and Market Potential.

All internal inventions are not commercially viable. Effective organisations evaluate their innovations based on its market relevance, competitive edge and scalability in addition to its technical quality. As an example, a manufacturing firm can create a machine-learning algorithm to decrease the amount of equipment down time. Although it was developed to optimise internally at first, it can also resolve a problem in the industry in general. To establish the potential of the market, it is necessary to conduct customer interviews, competitor mapping, and initial validation. Companies that excel in this area often apply innovation commercialisation assessment frameworks to evaluate which technologies are worth advancing.

1.2. Conducting Proof-of-Concept and Industry Testing

An emerging technology has to be experimented in the real worlds before it can take off in a commercial sense. An example of this is a pharmaceutical company which has come up with a fast diagnostic device and it can only be tested to have its response times, usability and clinical reliability confirmed by conducting pilot tests with the clinics. In the same way, a robotics company working in the industry may require testing of its prototypes on more than one factories before ensuring universality. Such practical tests make R&D more of a practical rather than theoretical development.

2. Protecting IP Prior to Introduction of Technology in the market.

2.1. Enhancing Patents, Trade Secrets and Defensive Publications.

The firms also need to protect themselves through intellectual property to avoid imitations and protect a competitive edge before commercialisation sets in. A chemical company which has found a new formula of solvents, say, needs to patent beforehand, so that it has a monopoly in the market. In the meantime, a software company can use the trade secrets to safeguard its proprietary recommendation engine. Late patenting or its lack can also destabilize the value of the technology in the market, and the bargaining strength of the company before the partners or investors.

2.2. Monetising IP Strategy With IP Intent.

The model of IP should be suited to the commercial model. When a company is looking to license its innovation to the international business community, the world-wide coverage of the patents will be necessary. On the other hand, an organisation with commercialisation to be made via direct sale might only focus on safeguarding the core algorithm, formulation, or process. Alignment provides cost efficiency protection and commercial maximisation.

Companies that structure their protections correctly often leverage the R&D technology monetisation strategy to support downstream revenue models such as licensing, franchising, or embedded product integration.

3. Choosing the Right Commercialisation Pathway

3.1. Direct Commercialisation Through Internal Business Units

The company is best placed to take some of the technologies to the market. A software company that has created an internal automation engine may choose to introduce it as a SaaS product on its own. This model provides the company with complete price control, branding and customer relationship. Nevertheless, it needs to invest heavily in sales, marketing and customer support as well. Direct commercialisation can generate recurring revenues and better brand equity in the long term in organisations with strong commercial capability.

3.2. Outsourcing Technology to other Companies.

Licensing would suit well with the companies, which possess high capabilities of R&D, but have limited distribution networks. An example is a university research department that may have found a new biodegradable material to pack their products, but they do not have the capacity to make it in large quantities. The university receives upfront payments and royalties as the formula is licensed to an experienced manufacturer of packaging and the partner produces the product and markets it. The predictable revenues that are provided by licensing without the need to expand its operations are an added advantage.

3.3. Establishing Joint Ventures or Spin-Off firms.

In other instances, it is always prudent to create a new entity. An imaging sensor breakthrough developed by a medical devices company may go out and establish a spin-off company funded by venture capital to speed the process of clinical trials and worldwide regulatory clearances. Joint ventures also enable risk-sharing, the pooling of infrastructure and speedy scaling. The structures are especially effective with technologies that demand specialised skills or inter-industry cooperation.

4. Creating a Scalable Go-to-Market Strategy.

4.1. Creating the Commercial Value Proposition.

Technology as described by R and D teams may be technologically oriented, such as speed, accuracy or performance, but not by outcome as desired by customers. It is a valuable logistics optimisation algorithm not because it involves highly-developed mathematics but because it saves 18 percent of delivery time and carriers money. It is necessary to translate the features of technology into the benefits of the business. Firms with explicitly defined value would achieve a quicker customer traction and reduce the selling process.

4.2. Setting up the Pricing, Packaging and Positioning.

The cost should also be able to reflect the strategic price of the technology and the willingness of the customer to pay. An illustration is an energy company introducing a predictive maintenance system where the cost per asset, per month is based on the operational savings of the system. In contrast, a hardware innovation can be bought once and accompanied with subscription-based analytics. Packaging: Tiered access, usage-based pricing, or enterprise licensing: The business can create value among the various segments of the market and have predictable cash flow.

5. Developing Long Term Technology Monetisation Capabilities.

5.1. The Development of Cross-Functional Commercialisation Teams.

Commercialisation of technology needs to be coordinated in the areas of R&D, marketing, finance, operations, and legal. The effective launch can be associated with engineers perfecting prototypes, marketers creating positioning, finance departments modeling profitability and legal counsel administering IP deals. Organisations that consolidate such functions into a commercialisation team of its own usually take shorter time to commercially bring products to market and also minimise such risks.

5.2. Setting up Feedback Loops of Ongoing Improvement.

After a technology has been taken to the market, the customer feedback will form the basis of further improvement. An example of health care software provider is one that receives radiologist opinions to optimize the usability of the interface or increase the diagnostic accuracy. These updates are competitive, ensure subscription prices, and enhance customer retention. Continuous improvement would see to it that technology will be commercially relevant even after the first release.

Conclusion

Commercialising in-house technology is a matter more than a matter of technical excellence it is a matter of strategic discipline, financial acumen and an organized implementation program. Finding commercially viable innovations, intellectual property protection, the optimal path to monetisation and the development of a scalable go-to-market engine can help companies transform R&D investments into profitable revenue streams. The success organisations are those who do not view technology as a research accomplishment, but as a commercial resource that can provide long-term and sustainable growth.