How to Calculate Amortization of Intangible Assets Step by Step

Guide on How to Calculate Amortization of Intangible Assets Step by Step

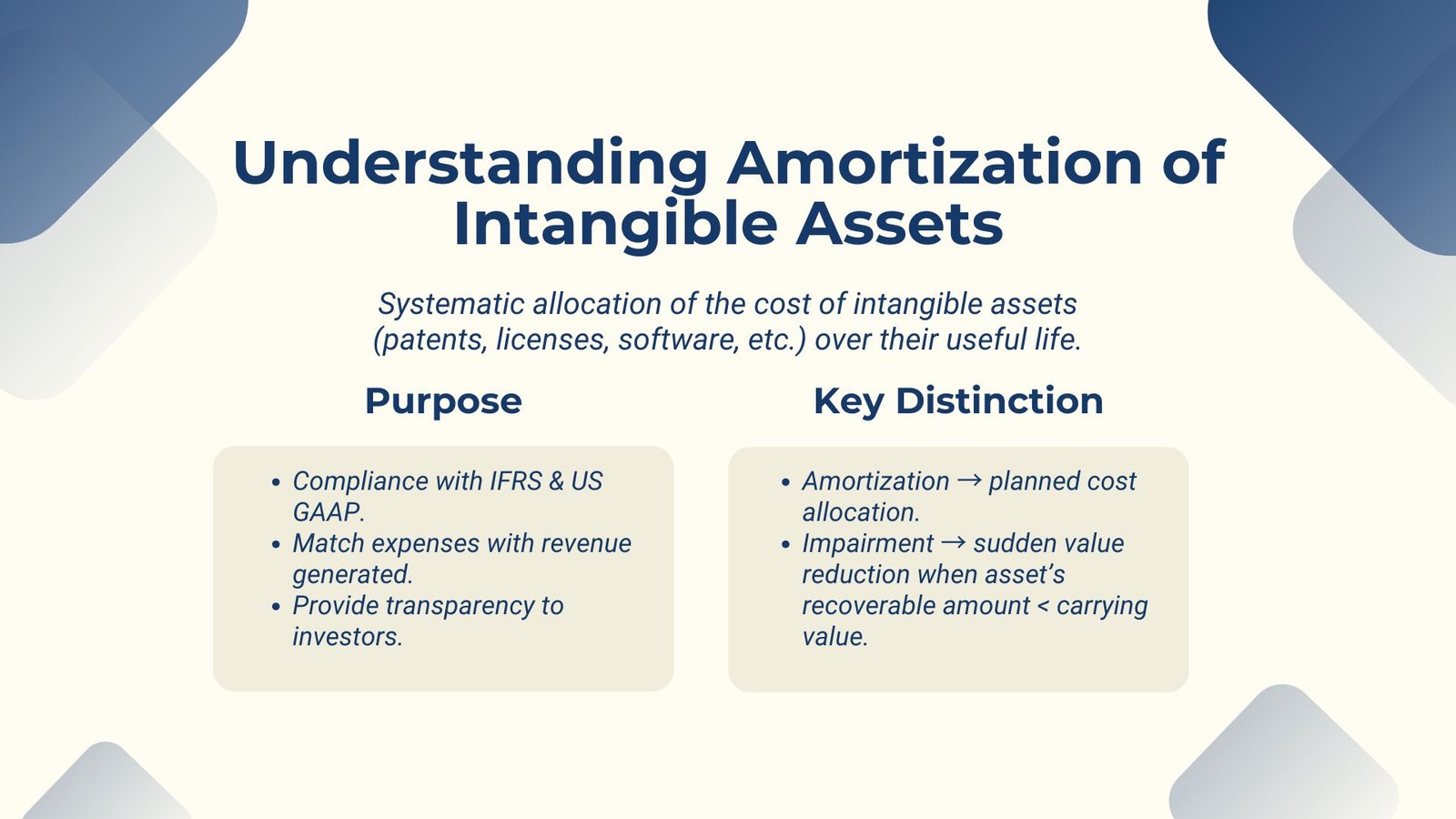

In accounting and corporate financial management, intangibleness can be a capital resource of some of the most worthwhile assets in possession of a company. These are intangible assets – i.e. things which have a value in terms of how much money they make a company but are not physical in a sense that a patent, a copyright or a trademark is or can become. They have no physical substance hence must have a particular way of cost allocation in financial reporting. This is referred to as amortization of intangible assets.

Amortization is both a compliance and a strategic thing. A compliance aspect of it is that this will ensure that the cost of intangible assets is charged over time when they are being used due to economic benefits created by them, in conformity with the accounting standards like IFRS and US GAAP. Due to its strategic impact, it impacts on the reported earnings of a company, the tax liability of the company, and even perceptions of its investors also.

Amortization is an important concept business leaders, investors and accountants should understand to get a clear picture of how it works and why it is important. Accounting skills upgrade courses for working adults often cover this essential area, and professionals may also benefit from a step by step guide to intangible asset valuation to strengthen both compliance and strategic decision-making.

Defining Amortization in the Context of Intangibles

Amortization is the methodical way of dividing the cost of an intangible asset over its useful life. It is similar in concept to depreciation which is used to account for tangible property such as machinery or buildings, but in relation to assets that do not have physical existence.

Amortization is done with the objective of spreading the expenses over the revenues the expenses help generate. When a company purchases a patent that is supposed to be utilized in the coming decade, the expense of the patent is not recorded instantly. Rather, the cost is allocated proportionately, and, in some cases, evenly, over the ten years, which is an indication of the asset consumption.

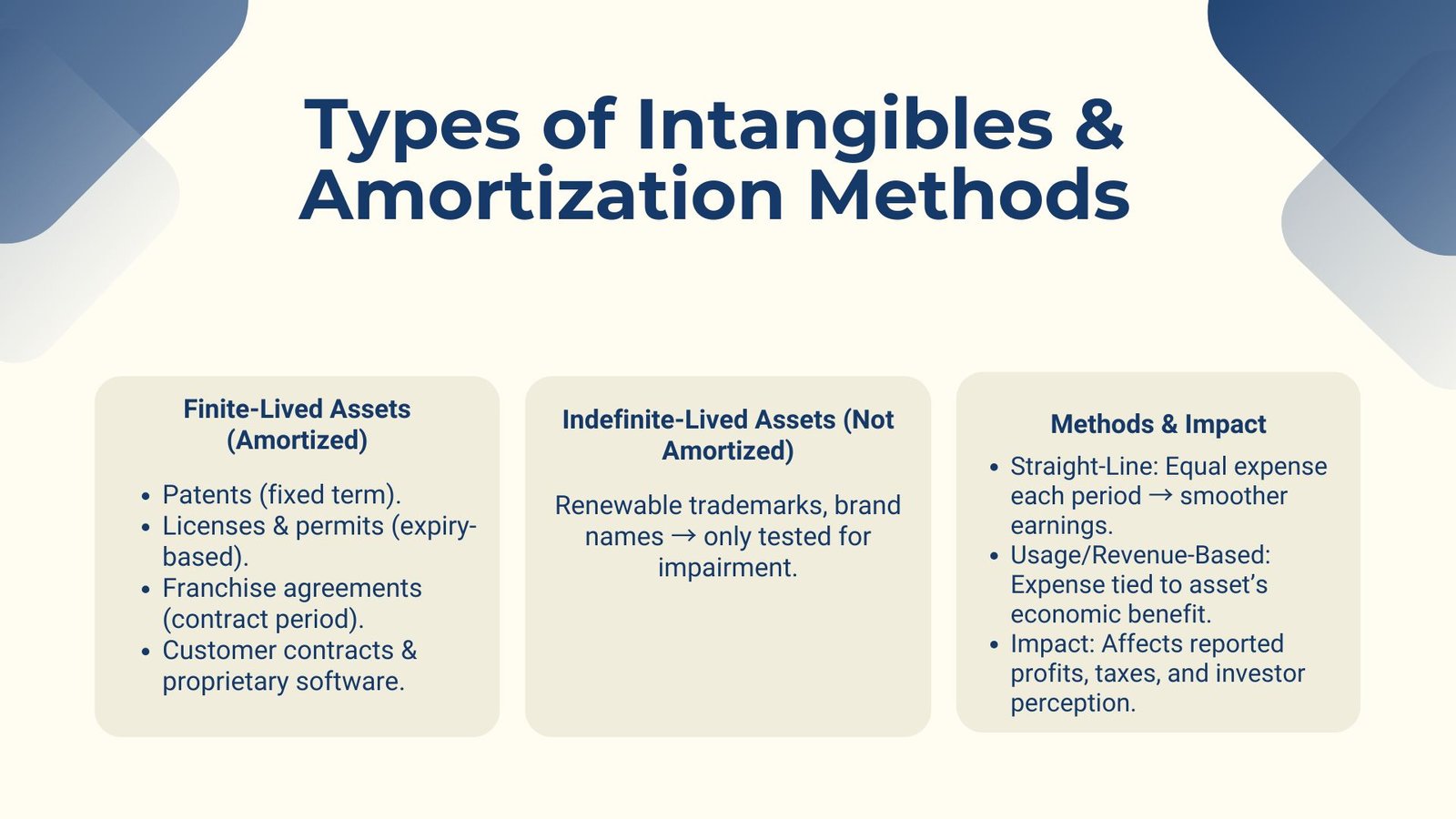

The accounting standards ask companies to write off limited life intangible assets, that is, the assets that have a limited useful life. These may be licenses that expire, customer contracts that have specific conditions, and software, which will have a reasonable term of usefulness. Never-amortized intangibles include indefinite-lived intangible assets (e.g., some trademarks or brand names, which can be perpetuated in the same form), and never-amortized organizational headings. Rather, they are put to the test to assess their impairment on the regular basis annually so that carrying value does not surpass the recoverable amount.

Types of Intangible Assets Subject to Amortization

All intangible assets cannot be treated in the same way The main determinant of whether or not to amortize is the life of the asset where the asset has an indefinite life then it does not require amortization otherwise.

Some of the examples of finite-lived intangible assets are:

- Patents: Tend to be granted over a specific period of time, after which a patent expires or must be renewed.

- Licenses and permits: Such are applicable to certain terms or specific conditions and they normally have expiry dates.

- Franchise agreements: Coterminous by time limit of contract.

- Contracts and relations with customers: they are reflected in purchases and are quantified by retention periods.

- Proprietary software: These are only useful until it becomes obsolete or is superseded by the new technology.

In the case of such assets, amortization starts at the time that an asset is placed into service and goes on until the useful life of the asset. The amortization period would depend on the shorter that

Intangibles that have indefinite useful lives, that is, some renewable trademarks or brand names are not subject to amortization. Rather, they have to perform a regular evaluation of whether these assets have experienced impairment or not.

Amortization Methods and Their Impact

It is stated that under IFRS (IAS 38: Intangible Assets) and US GAAP (ASC 350: IntangiblesGoodwill and Other), companies are to amortize finite-lived intangible assets over useful lives and it must be disclosed how and on what basis. The transparency is paramount, since the investors, as well as the regulators base their judgments on such releases in determining the financial health and performance of the company.

There are situations when a usage-based approach can be more suitable, especially in case of assets that experience a decay of benefits or an inherent fluctuation in their benefits. To amortize an example, consider a license where the revenues earned are high during the early years and decrease subsequently, the amortization may be performed as per the revenue, where the expense is matched better with the economic reality.

The amortization method has an impact on financial statements. Straight-line amortization results in steady recognition of expenses, which smooths out earnings. Accelerated or tailored approaches take the ability in an initial value and spend it before many years, lessening profits during a pivotal time frame even as it brings down the benefits in a later time frame. It can impact strategically on the profitability reported by a firm, taxes payable, or expectations of investors.

Financial Reporting and Compliance Considerations

According to IFRS (IAS 38: Intangible Assets) and US GAAP (ASC 350: IntangiblesGrgoodwinless and Other) intangible assets that have finite lives must be amortized against their useful lives and disclosure of methods and assumptions must be made. The information that is presented must be transparent since it is based on this disclosure of information that investors and regulators make judgment on the financial stature and performance of the company.

In financial statements, amortization expenses will be recorded in the income statement, and it will have an impact of reducing the net profit. Each period, the asset amortization reduces the carrying value of the asset on the balance sheet. The net book value will diminish as the book value will go towards the ZERO mark as the time moves on unless the asset is impaired.

The compliance is also applicable in tax regulations in addition to accounting standards. In most states, a deduction is allowed on the amortization of certain intangible assets which go towards taxable income. Nevertheless, tax regulations are not always similar to accounting regulations, so amortization as it is recognized in the financial statements may not be similar to the deductions, as they are accepted in taxes. This brings about temporary differences which need to be followed up and settled.

Strategic Implications of Amortization Decisions

Although amortization has its basis in accounting, it has a wider strategic impact on the financial management of a company. Amortization of costs may influence the reported profits, the tax and performance measurement due to the time and method of approach taken in the process.

In another example, allocation of purchase price to various categories of assets under acquisition accounting directly influences amortization costs. When greater value is placed on amortizable intangible assets, future amortization will be higher and it could help to increase profits as far as taxes are concerned. In contrast, putting more on non-amortizable goodwill levels out the earnings but forgoes the deductions.

It is a material matter in technology-driven industries that would influence financial outcomes depending on the decision on the useful life estimates. The aggressive write-off by underestimating useful life will tend to hasten the depreciation thus decreasing the short term profits with less chance of impairment. Over-charging useful life can provide a temporary saving, but exposes itself to the sudden write-down expenses, should the asset become obsolete earlier than estimated.

Such decisions involve a delicate practice of management of compliance, tax strategy, and investor communications. Firms also need to take into account the effect it has on its key performance indicators (KPIs) where earnings per share (EPS) or return on assets (ROA) have been identified as KPIs sensitive to amortization expenses.

Amortization and Impairment: Key Differences

One should make a distinction between amortization and impairment. Amortization is an expensed-in-kind which is predetermined over time and is carried out through a systematic method. On the other hand impairment is a drastic decrease in the carrying value of the asset which occurs when the recoverable amount of the assets becomes less than a book value.

The finite-lived intangible assets are not only amortizable but also impaired. As an example the period of amortization of a software license can be five years but it can be impaired in the third year in case of the availability of a better technology making it less valuable. Although intangible assets are not amortized, indefinite-lived ones must be tested every year to determine their impairment and written down, when impaired.

This difference is important to know with regard to financial reporting and making of decisions. The fact that a company is incurring heavy impairment charges could be an indicator to the market that the company has not accurately valued its asset or accurately estimated the market conditions, which brings an implication on investor confidence.

Conclusion: Why Amortization of Intangible Assets Matters

Intangible asset valuation amortization in Singapore is not just a technical accounting practice, but a mechanism that determines the format in which companies portray financial performance, manage taxation and how such companies communicate to its stakeholders. Amortization helps in matching the cost of intangible assets that have a finite life with revenues earned, meets accounting standards and gives a better view of the truth about the economy since the costs of the assets are spread out through their useful life.

To the management, the treatment of amortization can be related to profitability, cash flow and even how the business establishes itself strategically in the competitive markets. Reasonable estimation of useful life, proper selection of amortization methods and good documentations of assumptions are all requisites of solid financial reporting.

What the modern economy has taught, and amortization is a particularly good case in point, is that in the ever-increasing intangible asset case whereby much of the corporate value resides in intangibles, it is no longer an option to understand and manage amortization well, but a necessity. Effective regulatory compliance is pro-transparency and increases investor confidence as well as assists businesses to balance the conflict between regulations and strategic power.