How to Value Intangible Assets Under IFRS 3

Learn How to Value Intangible Assets Under IFRS 3

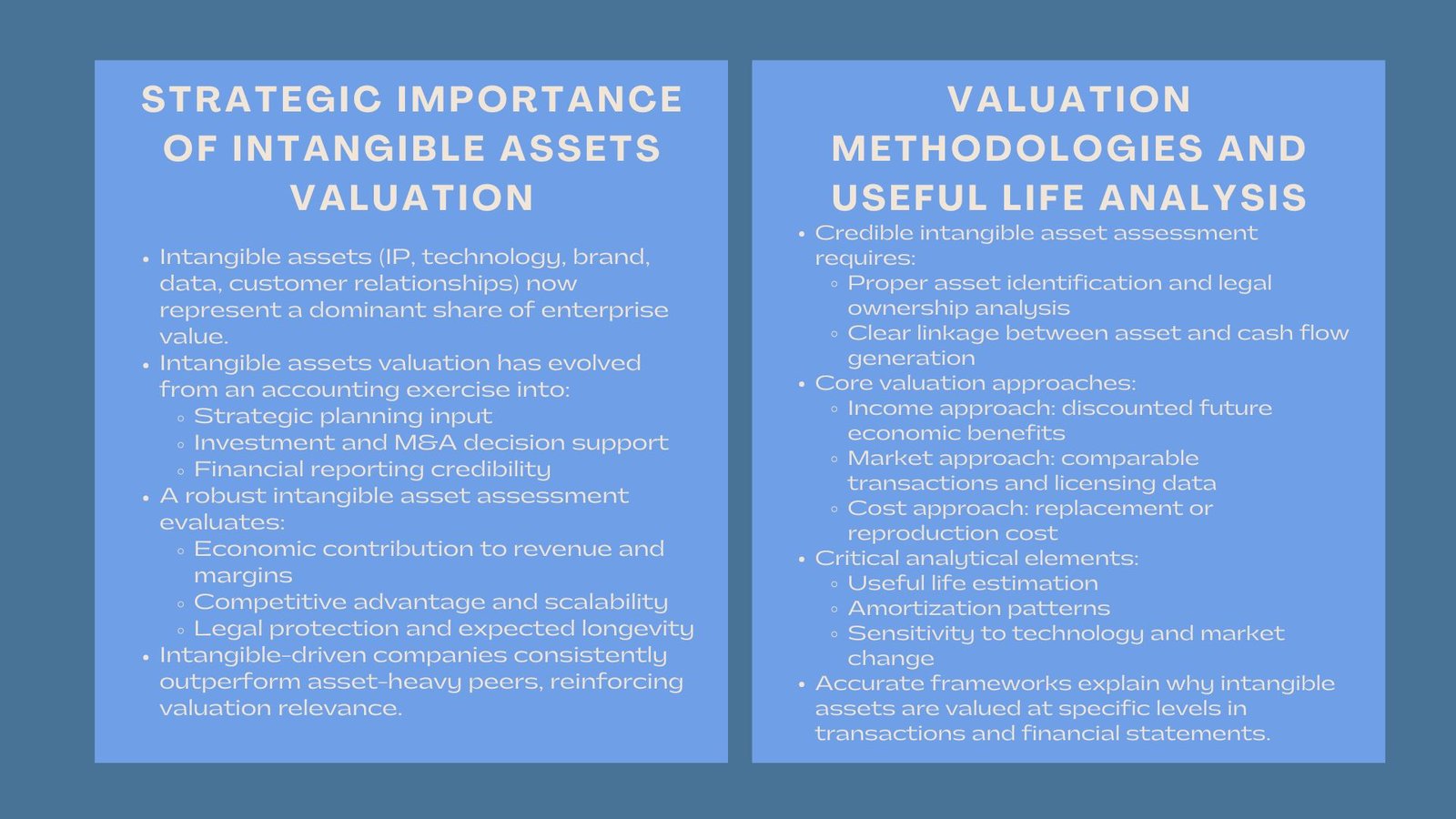

Discounting intangibles in the calculations during the business combinations process is a very critical but complicated process especially in the international financial reporting standards (IFRS) 3, which deals with the business combinations process. The need to determine how to recognize, identify and value intangible assets in a proper manner arises with the growth of a business through acquisition in order to fulfill the demand of the financial reporting stipulated by IFRS 3.

In this article we shall unravel the accounting of the intangible assets over the same framework, how we recognize these intangibles, how we value, what key factors we ought to consider and what practical issues are likely to arise in businesses. For companies seeking guidance, exploring accounting business valuation methods Singapore, the valueteam intangibles valuation Singapore process, and tailored approaches to intangible valuation for accounting businesses in Singapore can provide clarity and compliance.

Understanding IFRS 3: Business Combinations

IFRS 3 gives an acquisition body a guideline on how to execute business combinations within an organization which is often composed of mergers and acquisitions. Among its main requirements that there must be, as at the date of acquisition, recognition and measurement of the identifiable assets that are acquired and liabilities assumed by its acquirer. Noteworthy, this involves intangible assets- non-tangible assets like brand names, customer relationship, intellectual property and proprietary technology.

The IFRS 3 requires the acquisition method of the business combination. The acquirer must comply with the following under this method:

- Find out who acquires in the transaction.

- Find out the purchase date.

- Identify and estimate the identifiable assets purchased and the liabilities taken.

- Measure or recognize goodwill or gain on a bargain purchase.

In the case of intangibles, the IFRS s3 stipulates that such assets are to be stated distinctly independent of goodwill so far as they are traceable.

What Makes an Intangible Asset Recognizable?

As per IFRS 3 intangible asset should satisfy two requirements in order to be recognized separately to goodwill:

Identifiability

An asset is identifiable when it is either derived out of contractual or legal rights (whether in transferable or separable form) or when it is separable (that is it can be sold, transferred, licensed, rented, or exchanged- and in some cases in combination with a related contract, identifiable asset, or liability).

Control and Future Economic Benefits

The purchasing firm should be in control of the asset and anticipate economic gain out of the asset in the future. These benefits could either be in terms of revenue based revenues or in cost savings or other benefits that arise as a result of use of the asset.

Trademarks, customer lists, non-compete agreements, technology, and patents form some of the common examples of the identifiable intangible assets as contained in IFRS 3.

Distinction Between Intangible Assets and Goodwill

There is often a misunderstanding of the differences between intangible assets and goodwill. In terms of IFRS 3, goodwill is recognized as the amount in which an acquisition cost exceeds the fair value of identifiable net assets (the cost of the acquisition less fair value of the net identifiable assets including intangible assets). Put differently, any surplus amount, after adequately measuring all the identifiable assets, will be classified as goodwill.

Intangible assets should be recognized distinctly when they qualify in the identifiability tests. Improper identification and valuation of such assets may result in overvaluation of goodwill, as well as an incorrect estimation of the asset base of the company.

Key Intangible Asset Categories in IFRS 3 Valuation

There are a number of intangible assets which are often recognized and measured in business combinations. These include:

- Marketing-related assets: Trademarks, trade names, domain names.

- Customer-related assets: Customer lists, contracts, relationships.

- Technology-based assets: Patented and unpatented technology, software.

- Artistic-related assets: Literary works, music, videos.

- Contract-based assets: Licensing agreements, lease agreements, non-compete clauses.

All such assets necessitate a unique valuation procedure, agreeing to its nature, economic advantages, and the aspects to which it is or is not necessarily divisible relative to the business.

Common Valuation Approaches for Intangible Assets

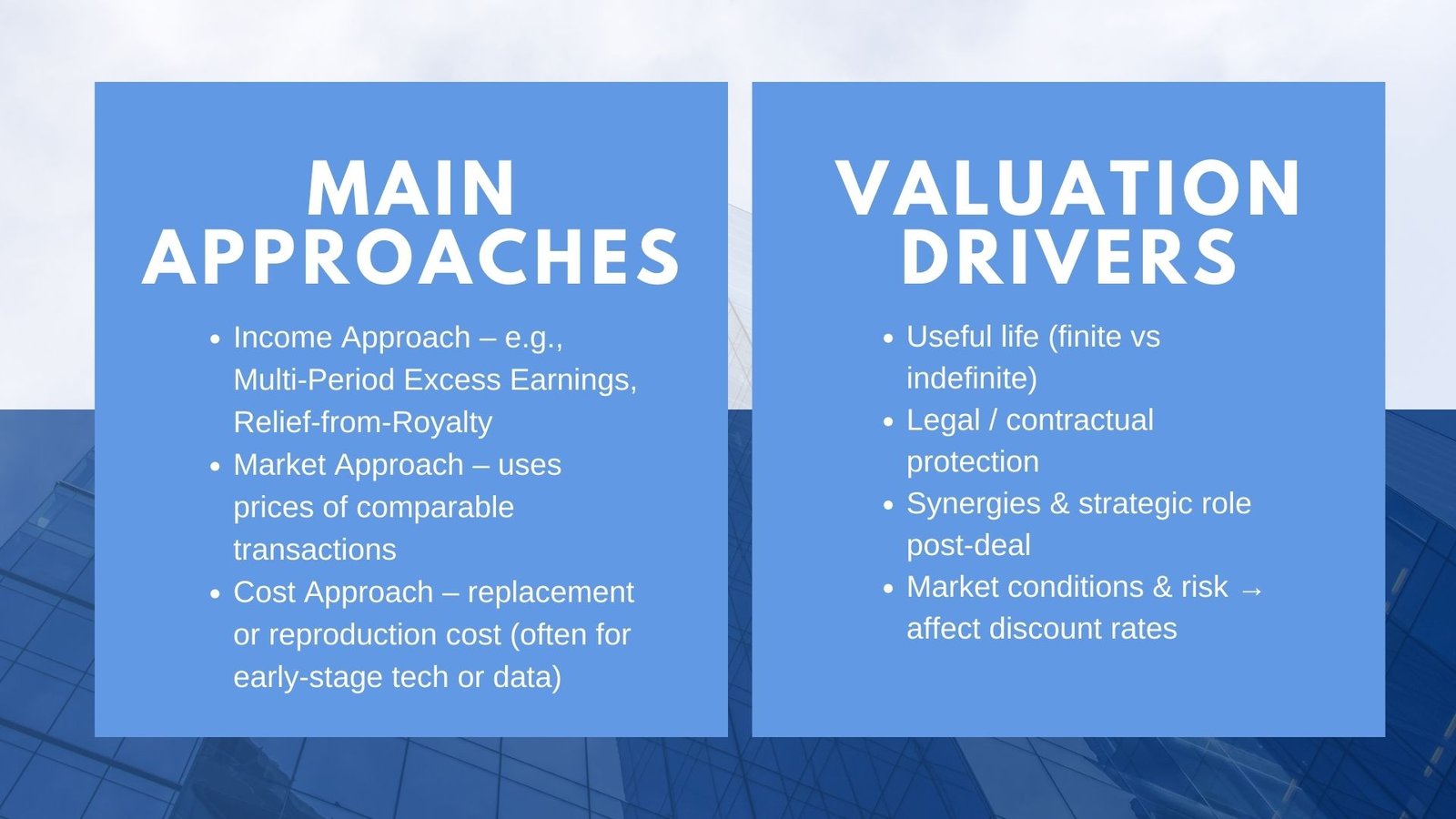

When valuing intangible assets under IFRS 3, three main approaches are used depending on the nature of the asset, data availability, and the purpose of the valuation. These are:

1. Income Approach

It is the most frequently used method by IFRS 3 valuations. It determines the worth of an intangible asset in terms of the cash flow that is likely to be generated by the asset in future in the present. Some of the methods under this approach include Multi-Period Excess Earnings Method (MPEEM), Relief-from-royalty Method and the Incremental Cash Flow Method.

Customer relationship valuing may, for example, be undertaken using the MPEEM. It is a means of isolating the cash flows that are only as a result of the asset and upon doing so, one subtracts applicable costs so as to deduct them to the present value and the suitable discount rate is applied.

2. Market Approach

The concept places an indefinite asset at the level of market dealings of other similar assets. It is the process of using a pricing multiplier depending on the comparable assets which have been sold or licensed in the market. Such a method is simple in theory but can seldom be applied to intangible assets because of the impossibility to find comparative transactions in the public sphere.

3. Cost Approach

Value ascertained through this approach is on the basis of a cost of recreating or substituting the asset with another aspect of similar utility. It is usually questioned when the intangible property is in early form or wherein the benefits in future are unknown or may be difficult to forecast. Cases such internally developed software or databases are where replicating costs are more quantifiable than the earning capability.

Factors That Influence the Valuation Outcome

While applying these methods, a number of factors can significantly influence the valuation outcome:

Useful Life of the Asset

The calculation of the remaining useful life of an intangible property influences the amortization process and also valuation. As per IFRS 3, it does not restrict the useful lives to be either finite or indefinite nevertheless, reasonable and supported assumptions should be made.

Legal or Contractual Restrictions

Patented or exclusively contracted assets are possibly worth more because such assets are legally enforceable and access to them by the competition is obstructed.

Synergies and Strategic Importance

There are asset values that may introduce new valuation to the company in terms of operational synergies or the competitive edge after the acquisition. Such indirect advantages can have an impact on the assumption of valuation and the supposed cash flow.

Market Conditions and Risk

The possible future economic benefits are also influenced by the current trends of the market, alterations to the regulations, risks specific to the market, etc. These factors should be considered in the discount rates to make a credible valuation at the same time.

Post-Acquisition Accounting and Amortization

Upon acquisition, the acquirer has to report intangible assets in the framework provided by the IAS 38 Intangible Assets. Fixed-life assets are amortized over the assumed life, whereas the indefinite life assets are not charged to amortization but are tested yearly in terms of the impairment.

Whenever an intangible asset becomes impaired which in the sense means its carrying amount exceeds its recoverable amount then a loss should be realized. This may affect reported income and cause audits of asset strategy, or performance.

Challenges and Common Pitfalls

Though the IFRS 3 has advised businesses in great detail to determine the nature of intangible assets, several businesses struggle to develop and define intangible assets.

Under-identification is one of them as not all of the qualifying types of intangible assets are reported. All this may occur because of absence of information, inadequate documentation, or time-limit during due diligence. In this case unneeded value can be overapportioned on goodwill.

The other difficulty in the case is having reasonable forecasts and assumptions, especially in adoption of the income method. Pre-mature valuation of assets based on a rosy cash flow envisage or an inappropriate discounting rate result in overvalued asset values which in turn will auger more failures in the future.

Moreover, businesses occasionally do not quite separate the acquired and internally generated intangible assets in an appropriate way. Only the acquired intangible assets are initially recognized at fair value, according to IFRS 3, with the more strict recognition criteria of internally generated intangibles having to be used in IAS 38.

Best Practices for Reliable Valuation

To ensure accuracy and compliance, companies are encouraged to follow certain best practices when valuing intangible assets:

- Find a valuation specialist with profound expertise and experience in IFRS 3.

- Early in the acquiring plan, take detailed documentation, contracts and records of all the possible intangible assets.

- Employ multi-disciplinary groups with law, finance and operational specialists in order to evaluate the value of asset and useful life.

- Strictly test assumptions that concern revenue growths, customer attrition and market conditions.

- Have a consistent record of valuation technique so that it may be audited and regulated.

Conclusion

Recognizing intangible assets on an IFRS 3 basis is not simply a regulatory requirement, it is a decisive move over to transparent, reliable and meaningful financial reporting. It also enables businesses to gain improved understanding of what they are actually buying, it enables accurate disclosure of financial statements, and post-deal accounting integrity. Whether the target assets are proprietary software, a strong brand or a long-term customer relationship, all are critical components of determining enterprise value.

The problematic aspects of identification, forecasting, and control are those applied widely; however, the existing valuation procedures can be efficiently addressed and overcome with the help of knowledgeable judgment. With the world having ever more of an intangible value based economy, the ability to understand the direction and implementation of IFRS 3 valuation becomes more crucial to the present economy and the corporate leadership as well as the finance profession.