Turning Digital Platforms Into Multi-Sided Marketplace Cash Cows

Turning Digital Platforms Into Multi-Sided Marketplace Cash Cows

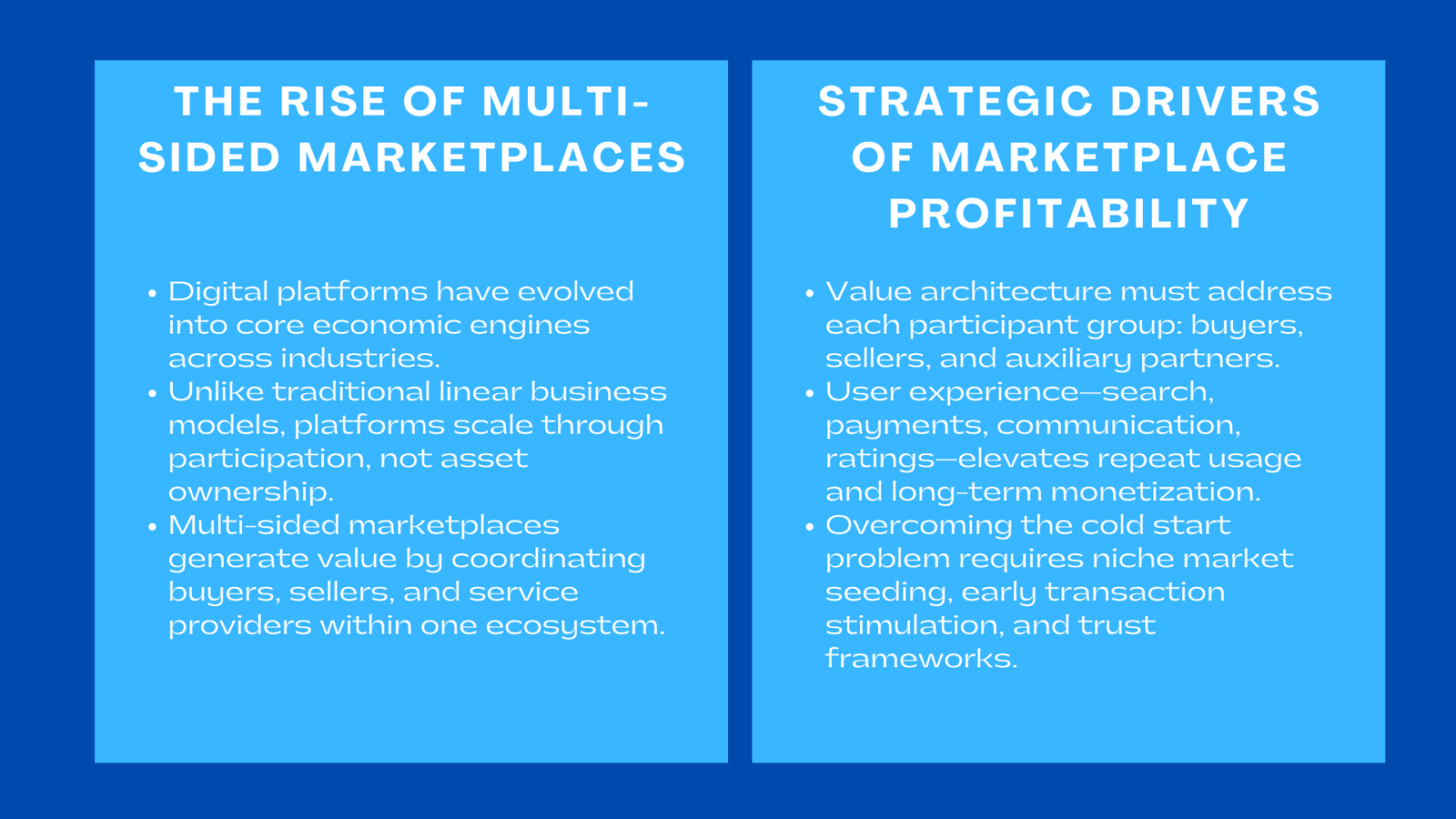

In the last decade, digital platforms have gone from being sidekick technology players in the economy to central ones. Their influence now permeates all industries, affecting the way value is created, the way it is priced, how it is exchanged and consumed. In contrast to the traditional business models based on fixed assets, that are linear processes and have limited scale, digital platforms have brought a flexible, distributed and exponentially scalable economic architecture. These platforms can be at the same time consumers, producers, service providers and advertisers within one unified ecosystem and generate massive value through coordination – instead of ownership. As the advent of digitization continues to intensify, platforms are more like adaptive networks than static products – and the new strategic imperative is to orchestrate interactions, not sell products.

Multi-sided marketplaces are at the top of the digital platform hierarchy because they are what unleash the most powerful type of value creation, network effects. A marketplace with a successful synchronization of multiple groups of users is a self-reinforcing economic machine where each interaction increases the utility of the platform. This compounding effect not only leads to a lot of growth, but also generates near-impenetrable competitive moats. Unlike linear businesses, which are how to build a profitable multi-sided marketplace platform scalable by capital investment and expansion of resources, marketplaces are scalable through participation. The more people are engaged, the more productive, liquid and profitable the ecosystem becomes. This maintains multi-sided platforms as able to develop into “cash cows,” platforms that generate recurring, high margin revenue, arising at very little marginal cost.

The Strategic Power of Multi-Sided Marketplaces

Network Effects as the Economic Backbone of Marketplace Superiority

Network effects are created where a product or service is more valuable the more people use it. While many digital services have weak or indirect network effects, multi-sided marketplaces create strong, direct and cross side network effects. The presence of sellers increases the value for buyers and the presence of buyers increases the value for sellers. This two-sided amplification leads to the organic growth of the platform, limiting the continued marketing expenditure. Once a platform has reached critical mass the cost associated with customer acquisition falls dramatically, whereas the value of the platform increases exponentially creating a kind of economic structure which, when compared to the most optimized traditional ways of doing business, does much better—similar to how a Singapore digital assets valuation training program gains more value as more professionals participate.

Liquidity as the Determinant of Marketplace Health and Profitability

While network effects make growth, liquidity makes a function successful. Liquidity is the when the users consistently find what they are looking for with no excessive delay or friction. A marketplace that has a high degree of liquidity emerges as a suitable channel for conducting transactions as it reliably serves user expectations. High liquidity makes transactions high in volume, trusts, and creates a habit. With the increasing liquidity, the platform will become the default marketplace for its niche and natural barriers against its competitors that can’t replicate the density or efficiency of the ecosystem.

Architecting Value for Each Side of the Marketplace

Differentiated Value Creation for Buyers, Sellers, and Auxiliary Users

A multi-sided marketplace will need to address each of the user segments as a strategic pillar of the marketplace. Transparency, efficiency of discovery, fairness of prices and trust mechanisms lowering perceived risk are required by buyers. Sellers require access to demand efficiently, operational tools to be robust and predictable in terms of earnings. Auxiliary participants like logistics providers, service partners, advertisers, software integrators, etc. will also need to get obvious and repeatable value. Crafting differentiated values of each side are not only for platform adoption, but also for platform stickiness. The more indispensable the platform becomes to every segment, the stronger are the network effects, the more stable the cash flow.

The Role of User Experience in Amplifying Marketplace Adoption

User experience is like glue that helps hold the marketplace dynamics together. The interface should make the complex interactions easy, reduce the uncertainty and the cognitive load for the users. Search, payment, rating, dispute resolution and communication functionality must all work seamlessly. When user experience becomes an intuitive and fluid thing, the marketplace becomes an environment that is habitual rather than one that is a tool. The tradition of use is the initial step to long-term monetization as the users have a natural dependency on the platform for repeated interactions.

Overcoming the Cold Start Problem

Focused Market Seeding as a Catalyst for Early Growth

The cold start problem occurs because the value of marketplaces is participation, but the users will not participate until value exists. The solution is to start in an intense niche where density is attainable in a short period of time. Where you can build up deep value in a small segment, you build proof of utility and build your way out from there. This strategy is similar to the one used by companies such as Uber, Airbnb and Etsy that first conquered hyper-local or highly specialized markets before becoming generic.

Jump-Starting Interactions to Trigger Network Acceleration

Before natural network effects can overtake, platforms need to take an active role of stimulating interactions. This could include subsidizing early transactions, manually onboarding particularly participants, or curating listings or even providing warrants to lower down on the danger. These interventions that are in the early stages set the basis of trust, liquidity, and engagement that will be required for the marketplace to move forward toward organic scaling. Once the number of users reaches a certain threshold, the interactions grow exponentially so the platform can shift from growing artificially to growing on its own.

Designing Trust, Safety, and Governance Mechanisms

Trust Structures as Economic Infrastructure

In multiple-sided marketplaces, trust is a hidden infrastructure which allows strangers to transact with confidence. Without trust, hesitation by users arises and the economic engine of the platform suffers. Trust is built through identity data, transaction records, open policies, secure payments, as well as ways designed to reward the good. Strong trust structures help alleviate the need for uncertainty and less transaction friction translates directly to more transaction volume and long term user retention.

Governance as the Stabilizing Force That Maintains Market Integrity

Governance involves the rules, methods of enforcement, or systems to adjudicate and guarantee fairness, consistency, and obedience. Effective governance helps to protect users, strengthen systems of reputation and to protect the ecosystem from abuse. Platforms with sound governance frameworks enjoy greater user satisfaction, less operational overhead and greater long-term profitability. Without governance, marketplaces quickly become chaotic places with deteriorating value, with a very fast turn rate for users.

Monetization Strategies for Marketplace Profitability

Designing Revenue Models That Strengthen Ecosystem Incentives

The monetization model is designed to decide if a market place will last for a few years or be a long-term source of cash. Proper Revenue Acquisition -> Revenue must be captured in a way that improves the user experience and not derail it. Successful monetization models are in tune with how and where the revenue should be captured relative to the interaction flow within the platform. If done well and without any noticeable extra cost, users do not see monetization as an additional expense; they see it as a part of the natural bargain.

Scalable Monetization as the Foundation of Marketplace Longevity

The beauty of marketplace economics is that recurring revenue is necessarily generated with very low marginal cost. As the ecosystem grows, more transactions can be added to it with almost no incremental spending, and this enables profitability to scale very quickly. A mature marketplace can be operated with thin operational teams and relies instead on the self-regulation behavior of its users. This financial efficiency transforms the market place into a stable and great income source.

Expanding the Platform Through Ecosystem Extensions

Vertical Service Integration to Deepen Value Chains

Once a marketplace gains stability it can expand economic power by incorporating verticals that play the supporting role for the basic exchange. Payment processing, logistics support, disputation, financing solutions, insurance products, and analytics platforms are natural extensions to increase switching costs and unlock new layers of such monetization. The platform becomes more than a place to transact, it becomes an infrastructure that users build their businesses or conduct their lives on.

Horizontal Expansion Into Adjacent Sectors to Grow Market Share

Horizontal expansion permits marketplaces to expand their addressable market without having to reinvent their existing architecture. By moving into adjacent sectors which have similar user behavior or demand patterns, platforms can scale quickly with consistency of operations. Horizontal expansion takes advantage of trust in brands, user data and network liquidity and is growing much faster than usual at a fraction of what the usual investment costs to expand.

Harnessing Data Flywheels and Predictive Intelligence

Data Flywheels as Self-Reinforcing Cycles of Marketplace Optimization

Every search and transaction, review, and a dispute produce valuable data. And when processed effectively, this data increases the accuracy of recommendations provided, reduces friction and improves the matching mechanisms. As the platform becomes more efficient, more people use it and the more data that is produced, the better it becomes. This self-reinforcing cycle is what creates the data flywheel – the central driver of marketplace intelligence and competitive advantage.

Predictive Intelligence as the Future of Marketplace Profit Maximization

AI-powered predictive models enable platforms to predict shortfalls in supply, surges in demand, detect abnormal activity and optimize pricing. Predictive intelligence creates a marketplace value orchestrator and changes the role of the marketplace from passive intermediary to active value orchestrator. Platforms that get predictive intelligence right can shape the behavior of users, personalize the experience and optimize revenue pathways with nervous precision.

Leveraging Network Effects as Competitive Moats

Why Large-Scale Marketplaces Become Natural Monopolies

Marketplace platforms are prone to turning into natural monopolies due to the network effects that provide high barriers to competition. Once liquidity is in place, once trust has been built, once all its elements have been refined, once the brand has been built, rivals have no hope of imitating the ecosystem. Users gravitate towards the platform where the activity is highest, meaning that the leader would get stronger over time while challengers stagnate. This dynamism guarantees great longevity of the market and an unmatched profit potential.

Translating Network Effects Into Financial Strength and Market Dominance

As network effects become more pronounced, financial advantages are realized for marketplaces that are unavailable to traditional businesses. Revenue gets more predictable, costs become more marginal and profitability becomes compounding. This economic structure creates the opportunity for platforms to reinvest into further expansion and the purchase of competitors, subsidies to grow users, and further expansion into other sectors to entrench their status as a necessary cash-producing body.

Building Operational and Financial Discipline for Scalable Growth

Strengthening Unit Economics to Support Massive Expansion

Unit economics are the analytical building block for scalable growth to be created. Platforms need to know what acquisition costs, transaction value and churn patterns, cohort, and user profitability over the long term. Strong unit economics allow platforms to scale with little degradation of margins, in order to make sure unit growth is directly channeling to free cash flowing.

Operational Excellence as the Backbone of Global Marketplace Expansion

Operational excellence is the key to ensuring quality as the market expands. Platforms need to optimize their algorithms, optimize infrastructures, support multiple users worldwide and maintain uniform standards across places. Operational resilience ensures innovation resiliency of the platform against volatility allowing it to confidently scale up and retain user trust.

Conclusion to Turning Digital Platforms Into Multi-Sided Marketplace Cash Cows

The path from digital product to multi-sided marketplace involves having the vision, the discipline, and a deep understanding of the economics of the ecosystem. Platforms that are effective at orchestrating value to many participants tap in to a compounding engine of growth without precedent in traditional business models. When backed by trust, liquidity, data intelligence and operational discipline, these platforms become long-standing income generating financial powerhouses at extraordinary payback scales. Their capability of scaling with the least increment of cost makes them right on the front of digital economy where value is no longer generated through the ownership of assets, but through orchestration of interactions.

Organizations that master the strategy of the market rise in the top of their industries, not by their aggression or control over markets, but by the way they construct environments where value flows naturally into their situation. These platforms have an impact on the ways consumers act, businesses function, and the way digital economies evolve. As marketplaces continue to dominate global commerce, strategies to scale digital platforms into cash-generating ecosystems, those able to turn digital platforms into multi-sided ecosystems will become the defining cash-producing institutions of the digital age – growing in new ways, accruing new levels of profit and assuming new technological leadership.