Turning Non-Compete Contractual Rights Into Financial Leverage

Turning Non-Compete & Contractual Rights Into Financial Leverage

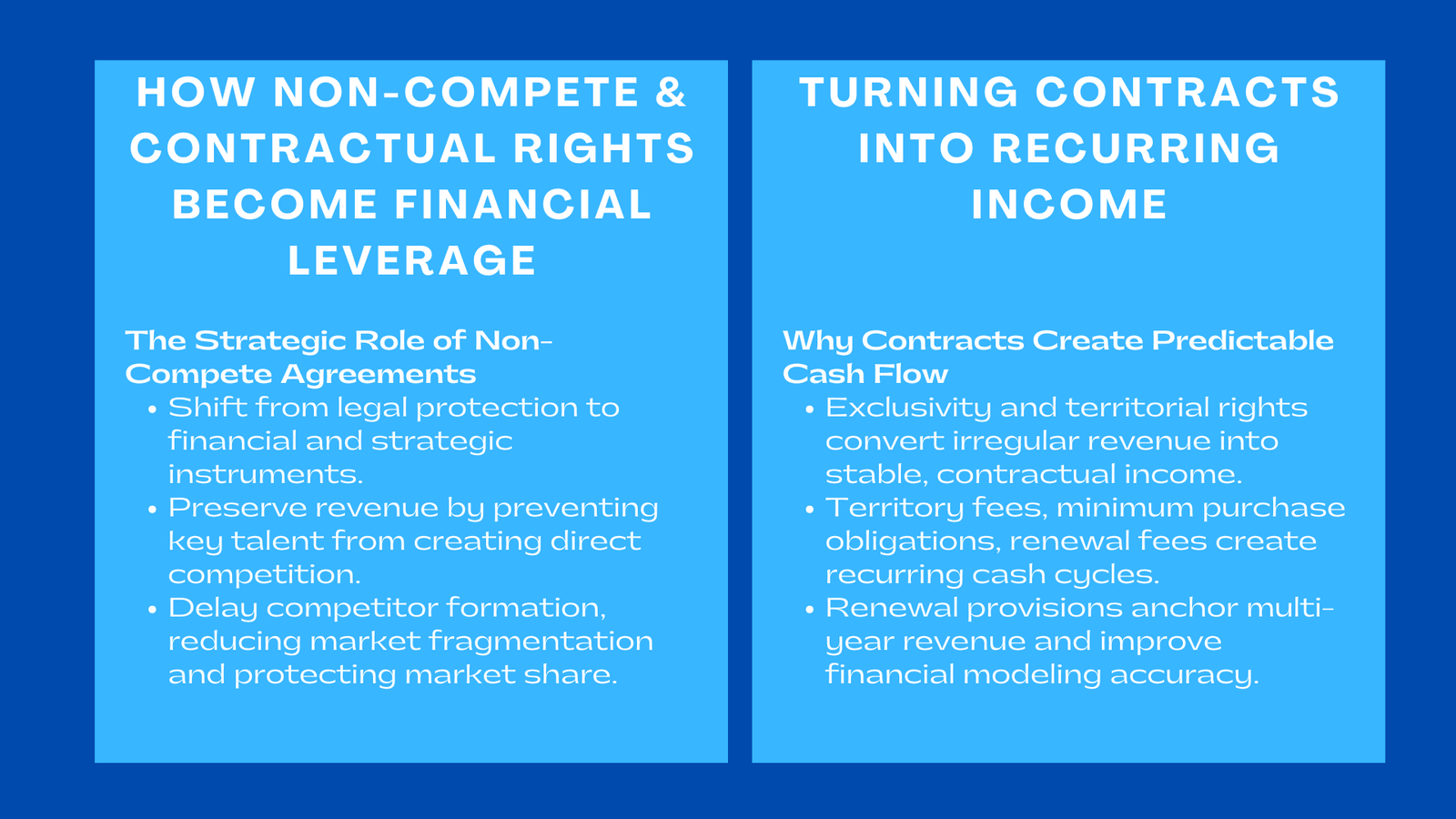

With the business world today becoming more of an intangible asset driven industry, non-compete agreements and contractual rights have emerged to be one of the least valued and, at the same time, highly rooted financial instruments. Although these provisions have traditionally been viewed as simple legal safeguards which tend to act as a way of control over the conduct of employees or the duties of a partner, they have developed into elements which impact positively on the value of an enterprise, negotiation, and competitiveness. Non-competes are being used by organizations in technological and financial, health care, consulting, manufacturing, as well as creative industries, not merely to avoid unfair competition, but rather achieve strategic control of the market, safeguard intellectual property, mitigate the fluctuation of revenues and improve predictability of future cash flow. Such changes are indicative of a more nuanced fact, namely, that modern businesses are no longer only defined by what they generate, but by what they are governed by by legal structures.

During the industrial era, the economic domination was through the control of the factories, equipment, distribution networks, and physical resources. This leads to power in the knowledge economy today where access, ideas, relations, intellectual capital and market permissions are the power giving factors. This shift has increased the significance of the contract rights: exclusivity, territorial rights, renewal clause, termination conditions and restrictive provisions. These rights have become a form of invisible economic lever that does what, when and on whom to do business in what how to use non-compete agreements as financial leverage in business valuation manner and within what limitations. Consequently, firms that recognize how to form, implement and commercialize contractual rights are bound to have more financial capacity than those that are dependent on production alone or innovation alone.

The Financial Logic Behind Non-Compete Agreements

Non-Competes as Revenue Preservation Shields

The essence behind the use of non-compete agreements is to ensure that the company is safeguarded in regard to its capacity to retain the revenue base. They deter the ex-workers, top management, consultants, or partners, who formulate or establish their own enterprises that directly menace the existing revenue sources. Then, even a single key employee leaving the company would cut the market share in those industries with short innovation cycles or that sell services as income. Companies may create a financial cushion that holds current revenue trends by adding delay to departure of a given stakeholder by legal means. This buffer will give some time to build on the relationship with the clients, enhance its product attributes and have a better internal structure that will be resilient to the effect of future competition, especially when understanding the role of valuation in financial due diligence Singapore helps organisations assess the financial impact of such protective agreements.

Delaying Competitor Formation and Market Fragmentation

The fact that non-competes postpones the appearance of new competitors is one of the biggest economic advantages of the package. The process of competitor creation does not happen overnight and has to be planned, financed, staffed, developed, and entered into the market. Legal obstacle in this is the non-compete restriction which slows this process. A time lag of twelve to twenty-four months will significantly decrease the intensity of competition. The market can evolve, the customers can turn into regulars or the internal innovation processes can progress. The presence of a competitor in the market has become more established by the time the law permits it to come into existence. The manipulation of timelines has a quantifiable financial benefit, which is usually mistaken but highly significant.

Contractual Rights as Strategic Negotiation Assets

Contractual Rights Shape Power Dynamics in Every Deal

Any contract brings unequal power distribution. The party possessing the stronger rights on the contractual matters facilitates the structures on which the bargains are done. Indicatively, a firm with exclusivity agreement has leverage since the other party cannot access through or expand without negotiating. A party who possesses termination triggers becomes leveraged since he or she is capable of quitting deals on favorable conditions. Even the mere words in a contract- like ownership of derived intellectual property or first right of refusal will impact significantly on the financial results of a negotiation. Such incorporated contractual rights have a very practical effect of being negotiated money.

Leveraging Contractual Structures for Better Financial Terms

Advanced corporations integrate contractual terms strategically so that they enhance their financial status in the medium and long term. These have renewal clauses, which help to increase recurring revenue, performance requirements, which guarantee predictable revenues, rights to audit, which is aimed at preventing fraud, confidentiality obligations which help in safeguarding competitive advantage as well as non-disparagement clauses which aim at safeguarding reputations. These clauses go well beyond tools of compliance; they are financial securities that bring predictability, decrease risk, and consequently increase valuation of enterprises.

Turning Contracts Into Predictable, Recurring Income Streams

Why Exclusivity and Territory Rights Produce Consistent Cash Flow

Contractual rights that are exclusive yield an income-generating cycle since exclusivity is something that has a price. Whenever a distributor, reseller or partner is given exclusive access to a product or a market, they can be expected to pay access fees, territory fees, yearly renewal fees, or at least an obligation to purchase minimum. These engagements convert what would have become unpredictable or seasonal revenue into income that becomes predictable and has been guaranteed through a contract. The rights holder would understand that it will be financially stable and the exclusive partner would have a competitive advantage. The advantages of such a reciprocal relationship establish a financial ecosystem in which exclusivity is an asset to be sold.

Renewal Structures That Anchor Long-Term Revenue

Automatic renewals of contracts or extension on the basis of the performance measures are effective monetary anchors. Indicatively, there are multi-year earnings which are generated by contracts that have a two-year or 5-year cycle of renewal without the need to be renegotiated. The cash flow of the company is more predictable when the future of the company and renewal rights are put into practice. Predictability increases investor confidence, decreases revenue volatility and increases the accuracy in financial modeling. These renewal provisions in the long run are considered as subscriptions and their effect is that they will yield recurring income which compounded in a year.

Non-Compete Agreements as Intellectual Capital Protection

Guarding Proprietary Knowledge in the Knowledge-Economy Era

The non-compete agreements play a critical role in securing the proprietary knowledge and these are the knowledge that cannot be fully stated in documentation but is rather held in experience and mental concept of the employee. Such tacit knowledge consists of strategic thought process, customer history, product roadmap, negotiation methods, operation processes and the back room of technology or services model. In the case of the departure of key employees, the knowledge turns into a competitor directly. Non-competes will make sure that even when employees leave, they do not leave and exploit this knowledge at the expense of the company. This safeguards the earnings of the future, competitive edge, and enhances stability in the market in the long run.

Preventing Customer Migration and Relationship Disruption

Sometimes, customers follow people and not the companies. The fact renders non-solicitation and non-compete provisions adequate in maintaining relationships with the clients. Companies are effectively keeping customers loyal, preserving revenue and protecting the long-term client value by banning, through legal means, former parts of the team as they solicit customers or make approaches to customers. In the case of companies that have recurring service contracts, subscription-based business, or long-term retainers, these shields are squarely linked to the survival of the business and valuation of the enterprises.

Contractual Rights as Formalized Financial Infrastructure

Why Contracts Should Be Treated as Revenue-Bearing Assets

The economic power of the contractual assets are underestimated in most companies. Contracts govern the bloodline of business, the revenue relations, intellectual property application, the supply chain commitments, distribution channels, as well as the partnership commitments. Any contract is not a legal document only but a financial tool, which establishes cash flow in a contract, cash owed, and competitive restrictions. Companies can access a new horizon of strategic and financial leverage when they start incorporating contracts as the asset portfolio. Shareholders are paying more attention to firms in terms of contractual strength, rather than company operations.

Contracts Reduce Uncertainty, Therefore Increasing Valuation

The value of any business is dependent on the future cash streams that are likely to be received discounted at the rate of risk. Clarity and enforceability of rights of a contract go a long way in mitigating such a risk. The future earnings of a firm in a case where the company has good non-compete, guaranteed purchase, long-term service, intellectual property protection and locked-in renewal cycle is more certain about the earning. This predictability lowers perceived risk of investors, as well as increases valuation multiples. The direct financial contribution of contractual strength thus has a good effect on the market performance of the company as it enhances the market position of the company in terms of fundraising, acquiring, and forming strategic alliances.

How Contractual Rights Shape Competitive Landscapes

Controlling Market Entry Through Legal Boundaries

The non-competes and exclusivity agreements are not only protecting the companies, they are creating whole markets. The creation of barriers to entry occurs when the major players barricade customer segments, establish entry barriers into regions, or partnership networks by legally binding competitors with the help of contracts. Such obstacles affect the price, market share, and competition over the years. Firms that monitor the boundaries of the contractual agreements can determine the rate, flow of competition and its organization. The legal control has its financial results that are more stable and predictable than the operation tactics themselves.

Using Contracts to Build Advantageous Ecosystems

In place, carefully built contractual protection of the business non-competes, exclusivity, confidentiality, licensing and intellectual property can be seen as very effective ecosystems of protection, the fortress of a company, so to speak. The contracts strengthen one another and restrict freedom of competition and optimize the financial security of the rights holder. In the long run, such an ecosystem will evolve to a moat into which competitors find it difficult to break. Organizations that have distinguished contractual ecosystems work knowing they are more confident, have better margins, and stability in the long run that is effective to both shareholders and other stakeholders.

Conclusion to Turning Non-Compete Contractual Rights Into Financial Leverage

The nature of non-compete agreements and contractual rights has passed beyond their inception as legal guarantees and into the stratosphere as an intricate financial vehicle as a determinant of enterprise value and competitiveness. These rights are unique in that they offer companies a combination of protection, predictability as well as control, all of which increase financial leverage in quantifiable means. Non-competences slow down the threat of competition, ensure the safety of intellectual property, and maintain relationships with customers. The performance of the contractual rights articulate revenue streams, delineate barriers to entry and enhance the bargaining positioning. The combination of them allows establishing a framework of strategy allowing stabilizing the cash flow, raising valuation, and strengthening the competitive advantage in the long term.

The competitive dominance in the future lies with those companies who master the contractual strategy. There will always be the question of operational excellence, however, legal control is the domain over markets, competition, intellectual property, and access that will determine the ascending and descending of who. Those companies which turn the contractual requirements into recurrent income, shielding mechanisms, and strategic advantage will enjoy some rate of stability and strength that its operational models are unable to compute. The most effective businesses in the upcoming decade will adhere to this change and strategic ways to monetize contractual rights for predictable revenue growth and plan their contractual ecology consciously, accurately, and economically. Contractual leverage is not just about a legal aspect, the contractual leverage is the second line of corporate armour, profitability, and the standing.