Understanding IAS 38 Standards for Intangible Asset Accounting

Learn Understanding IAS 38 Standards for Intangible Asset Accounting

Intangible resources are in many cases the most important assets to a company in the current knowledge base economy. These assets include patents and trademarks, proprietary software, brand reputation, and customer relationship and are capable of creating substantial future economic value regardless of their lack of material embodiment. Nonetheless, it is not even close to simple to value and account for them, which is why many companies rely on professional intangible asset valuation experts.

The International Accounting Standard Board (IASB) released IAS 38: Intangible Assets to introduce homogeneity, exposure and contrastability in financial reporting. This standard establishes the guidelines to identify, measure, amortize, and present the intangible assets in relation to the international financial reporting standards (IFRS).

If you are an accountant, an investor, a business owner, or a corporate executive, it is important that you understand IAS 38 in order to make the right business decisions by interpreting the financial statements accordingly. This guide effectively demystifies IAS 38 by outlining the fundamental concepts and the working implications in an understandable and easy manner.

Understanding the Purpose of IAS 38

IAS 38 lays down the basis of accounting intangible assets by the companies to ensure that their economic reality is reflected in their financial statements. In the absence of these directions, businesses might treat intangible assets differently, expensing in some and capitalizing in others, and thus in a way that would jeopardize comparison of businesses.

The standard guarantees recording of intangible assets only with some conditions being met to avoid overstatement of the assets and profits. It also establishes policies on amortization of such assets on their useful and impairment tests.

In practice IAS 38 seeks a compromise: on the one hand, it realizes that intangible assets may have great value but on the other hand it takes into account that it is always uncertain whether intangible assets have a value and that the assessment is performed by basing on supportable evidence.

Definition and Recognition Criteria

IAS 38 outlines an intangible asset to the following: A major intangible asset that can be identified.

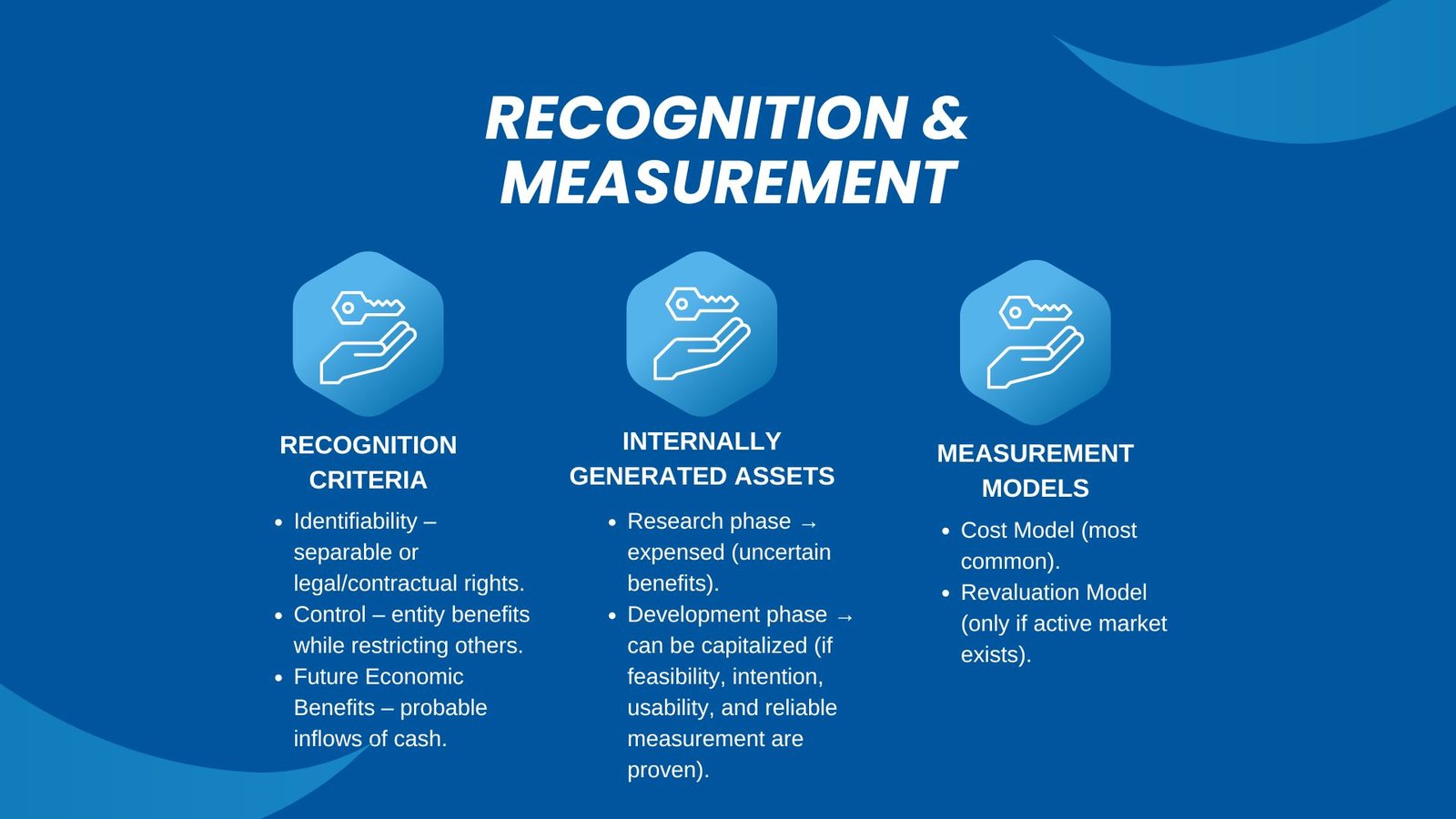

The three important recognition conditions to be met by an asset so that it falls under IAS 38 are:

- Identifiability – The asset is to be separable (has the ability to be sold, transferred, licensed or rented) or it comes out of contractual or legal entitlements.

- Control – The entity has to be able to derive future economic benefits to the asset and be forced to rival other parties.

- Future Economic Benefits – The asset should be likely to have cash inflows or less inflow of cash in the future.

In the event that these conditions are not fulfilled, the expenditure is usually charged against profits as expensed and not an asset.

The nature of the difference between acquired and internally generated intangible assets is an important element of IAS 38. Purchased assets or in business combinations are normally simpler to finish up as they can be substantiated with external documentation since their determination of cost as well as value can be formulated and verified. Assets created on the inside, like the brand value or customer lists built up during the years are subject to more narrow recognition criteria.

Internally Generated Intangibles: Research vs. Development

Probably the most notable section of IAS 38 is the treatment of internally generated intangibles in regards to expenditure on research and development (R&D).

The standard makes a distinct usage of separation between a research phase and a development phase:

- Research phase – Phases that are directed at acquisition of novel knowledge or new understanding. The funds spent during this period should be charged to expensed since it is not absolutely certain that they will bring economic benefits in future.

- Development phase – The processes that use research results to come up with the new products, processes or services before the commercial production. With some strict criteria such as technical feasibility, intention to complete, ability to use or sell, and reliable cost measurements, capitalization of expenditures can be done in this phase as intangible assets.

The difference between the two provides that only development expenses which are likely to be realised in the future utilisation are considered as assets, whereas speculative or initial-stage research expenses are written off.

Measurement and Amortization under IAS 38

IAS 38 allows for two models of measurement after recognition:

- Cost Model – There is an asset carrying at the cost of the asset net of accumulated amortization and impairment losses.

- Revaluation Model – It is the carrying of the asset at a revalued number, with reference to fair value, less subsequent impairment and amortization. This model is permissible only in cases where an active market exists in the asset, which is not a frequent occurrence when it comes to most of the intangibles.

The cost model is being used by most entities due to the rare existence of active markets on any intangible asset.

In the case of amortization, IAS 38 provides that intangible assets that have a limited useful life be amortized, but systematically over that life in the pattern in which the future economic benefits of the asset are being consumed. When such a pattern cannot be reliably established, the straight-line is applied, making it crucial to understand how to determine value of intangible vs tangible business assets and how amortization applies to intangible asset cost allocation in practice.

Intangible assets that are indefinitely lived, like some trademarks, are not to be amortized but each year need to be tested under impairment. This is to make sure that their carrying amount is not more than their recoverable amount.

Impairment and Disclosure Requirements

IAS 38 is used together with IAS 36: Impairment of Assets so as to avoid overstating the intangible assets. The procedure of testing the possibility of the impairment of an intangible asset occurs in cases where there is an indication that the intangible asset is threatened by impairment, e.g. dropping the flows of profits of patented product or introduction of better competitive technology. When the carrying amount is greater than the recoverable amount, an impairment loss is identified as a profit or loss.

Another aspect is disclosure. The details provided by IAS 38 regarding intangible assets necessitate an entity to reveal the particulars of intangible assets as follows:

- Depreciated lives or amortization.

- Amortization methods.

- Amortization accretion and gross carrying.

- Adjustment of unsatisfying beginning and ending of carrying amounts.

- The impairments or revaluation

The disclosures assist in illustrating the nature, value as well as the performance of the intangible assets to understand their influence to the investors and other stakeholders.

Practical Challenges in Applying IAS 38

Although IAS 38 has descriptive clauses that are easy to understand, it is easy to apply in practice. Intangible assets, particularly internally generated ones, are often difficult to value because there are no active markets to determine prices and because it is unknown how much future value the asset may be able to generate.

An example of this is that it is hard to know how long it takes software to become obsolete; in which case, hardware becomes obsolete within a short period of time. In a similar manner, deciding on whether a brand possesses indefinite life may see subjectivity decisions on consumer trends and competition.

The other challenge is that determining between research and development costs in the innovative industries is another challenge. The stage at which project research becomes development is a matter of professional opinion and mistakes that arise in this determination may cause great variations between declared profits and asset value.

Businesses also need to ensure excellent documentation to validate capitalization judgements, useful lives as well as assumptions used in testing of impairments. Auditors will want to see evidence of the process to have recognition criteria met and valuations being done on a sound methodology.

Why IAS 38 Matters for Stakeholders

As an investor, IAS 38 helps to get an idea of what is going to make the company grow in the future even though it remains intangible. These assets facilitate the evaluation of the competitive power, the ability to be innovative and the sustainability of profit.

With regards to the management, IAS 38 provides a methodical way of managing and reporting on intangibles, and this can enhance governance of strategic decision making. The identification and valuation of intangible assets enables companies to make better resources allocation decisions, develop plans to renew or upgrade the assets, and optimize their tax planning.

IAS 38 gives reliability and comparability of information on intangible assets across industries and between countries as such assets are properly recognized and measured by regulators and auditors.

Conclusion: Simplifying a Complex Standard

IAS 38: Intangible Assets consists of an essential part of IFRS that proposes the means in which intangible assets should be taken on the books, measured and presented in such a manner that the ability to reflect an accurate picture of the economic worth of the assets is being achieved. Although the application of the standard may be difficult-particularly on R&D capitalization, the useful life estimation and impairment testing-it is critical in the way of boosting transparency and comparability of financial statements.

As intangible value starts becoming more important than physical resources in a business environment, it is crucial that the professional understands IAS 38 to do accurate financial analysis and make informed decisions. Those companies that implement the standard diligently are not only in the fulfilment of IFRS, but also investors and stakeholders are able to obtain a more complete picture of the economic reality of the business.